SAS AML: in summary

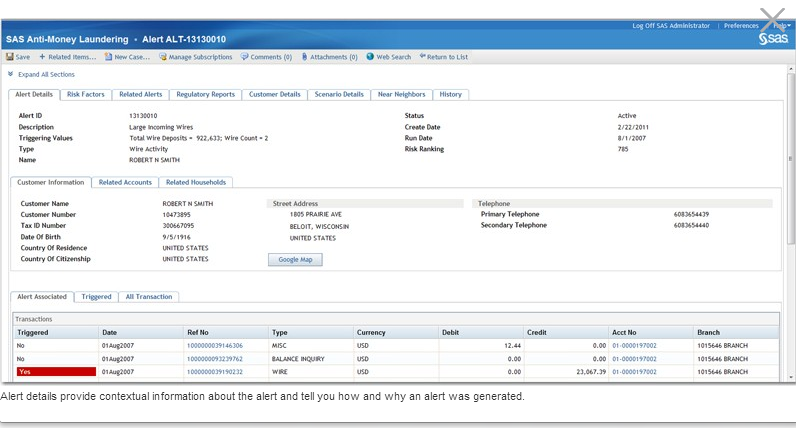

SAS AML caters to financial institutions by revolutionising fraud detection and compliance management. Designed to streamline operations, it offers dynamic monitoring capabilities and robust data analysis, setting itself apart with advanced pattern recognition and a user-friendly risk management system.

What are the main features of SAS AML?

Enhanced Fraud Detection

SAS AML focuses on enhanced fraud detection that leverages advanced analytics and machine learning to identify suspicious activities. This is crucial for financial institutions to mitigate fraud risks effectively.

- Real-time transaction monitoring

- Advanced pattern recognition

- Automated anomaly detection

Comprehensive Risk Management

With an emphasis on comprehensive risk management, the software provides a scalable and adaptable framework to assess various risk factors, ensuring compliance with diverse regulatory requirements.

- Dynamic risk scoring

- Customisable rule sets

- Integration with external data sources

Efficient Compliance Processes

Optimise your compliance operations with SAS AML’s efficient compliance processes. It streamlines the workflow to maintain regulatory adherence while reducing operational costs.

- Automated reporting and documentation

- Flexible audit trails

- Multi-jurisdictional compliance checks

Its benefits

SAS AML: its rates

Standard Rate On demand |

|---|

Clients alternatives to SAS AML

Appvizer Community Reviews (0)

No reviews, be the first to submit yours.