Lexware lohn+gehalt : Effortless Payroll Management for Small Businesses

Lexware lohn+gehalt: in summary

Lexware lohn+gehalt is designed for small to medium-sized businesses seeking efficient payroll management. Streamlining salary calculations, automating payslips, and ensuring compliance with legal regulations are its core strengths, making it a standout choice for straightforward financial administration.

What are the main features of Lexware lohn+gehalt?

Comprehensive Payroll Calculations

Lexware lohn+gehalt offers a robust solution for processing payroll with precision, reducing errors and saving time.

- Automatic calculation of statutory taxes and social security contributions.

- Integration of bonuses, overtime, and deductions into salary slip generation.

- Regular updates to reflect tax changes and ensure compliance.

Automated Payslip Generation

Transform the way you handle employee payslips by automating their creation and distribution.

- Seamless issuance of digital payslips to employees, ensuring timely distribution.

- Options for personalisation to suit company policies and branding.

- Effortless tracking of past payslips for record-keeping and audits.

Compliance and Reporting

Maintain peace of mind knowing that your payroll practices align with current legislation.

- Automatic updates for legal compliance, keeping your payroll system up-to-date.

- Comprehensive reporting features to generate insights and meet regulatory requirements.

- Export options compatible with accounting software to simplify financial reporting.

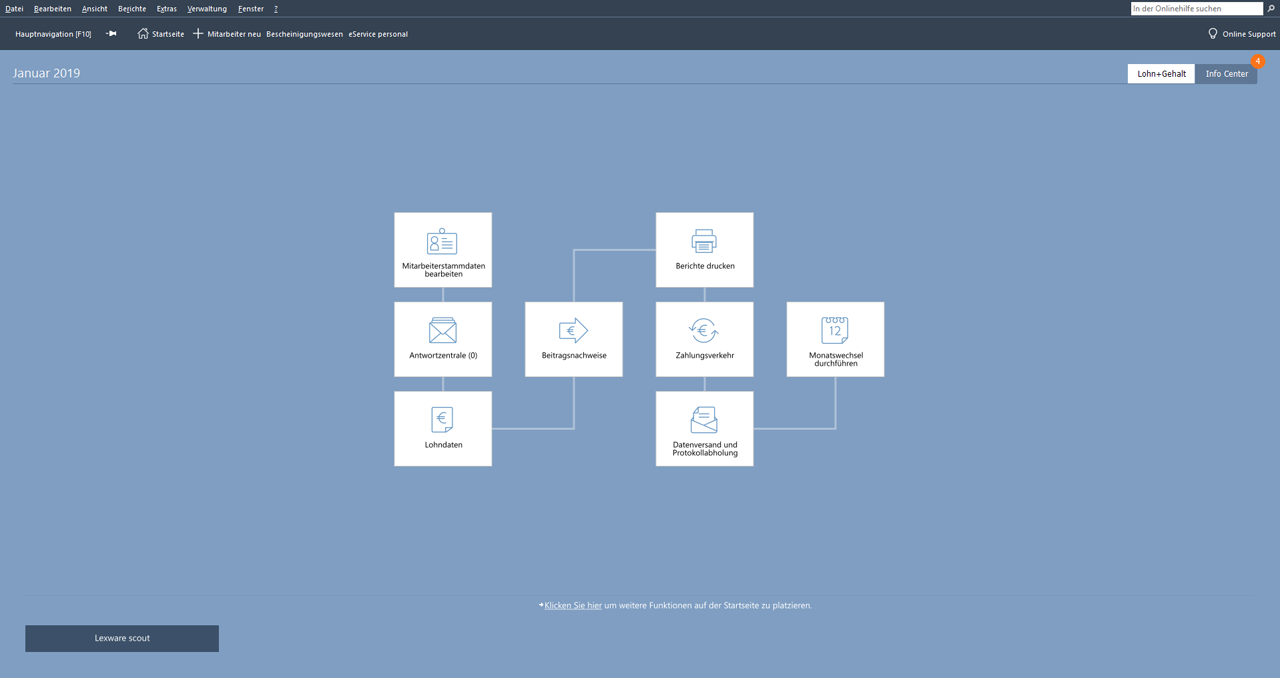

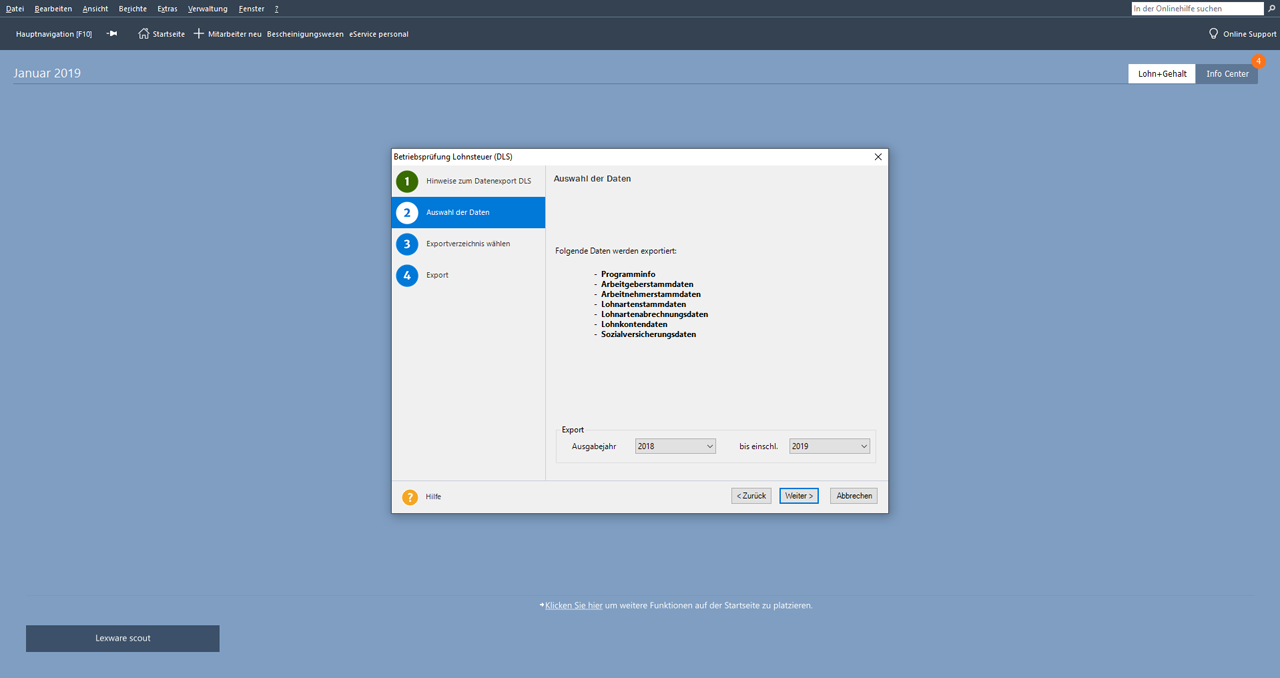

Lexware lohn+gehalt - Screenshot 1

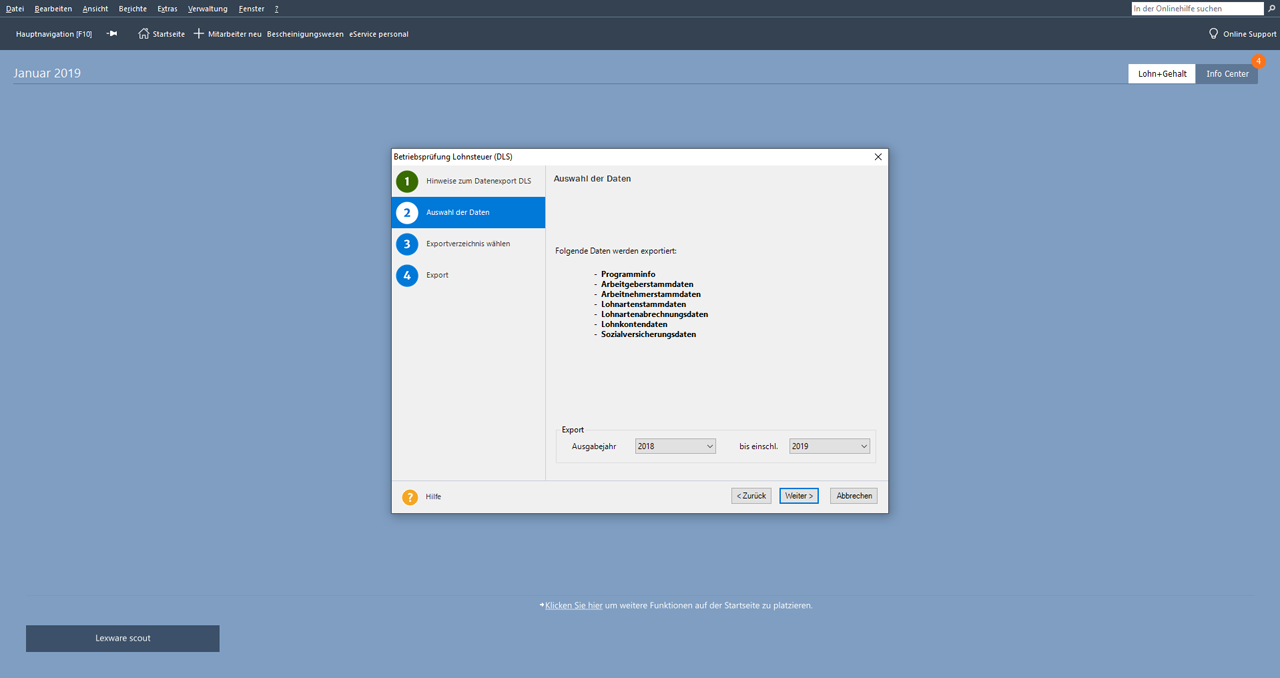

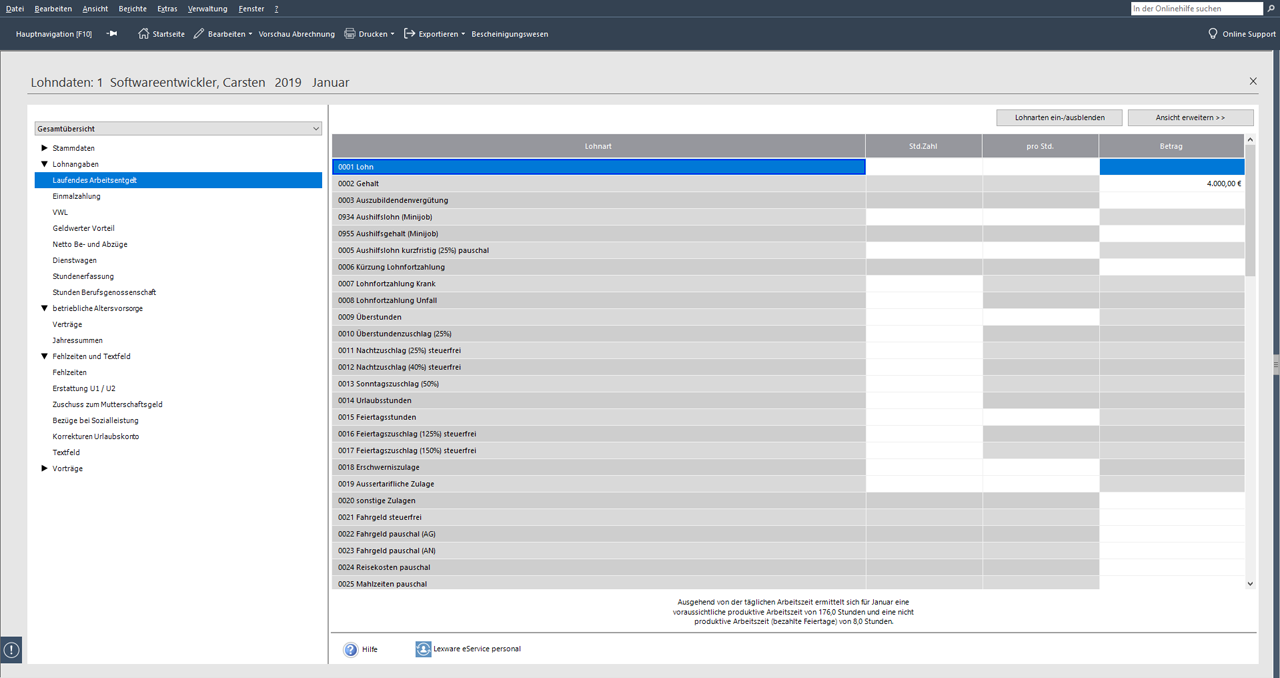

Lexware lohn+gehalt - Screenshot 1  Lexware lohn+gehalt - Screenshot 2

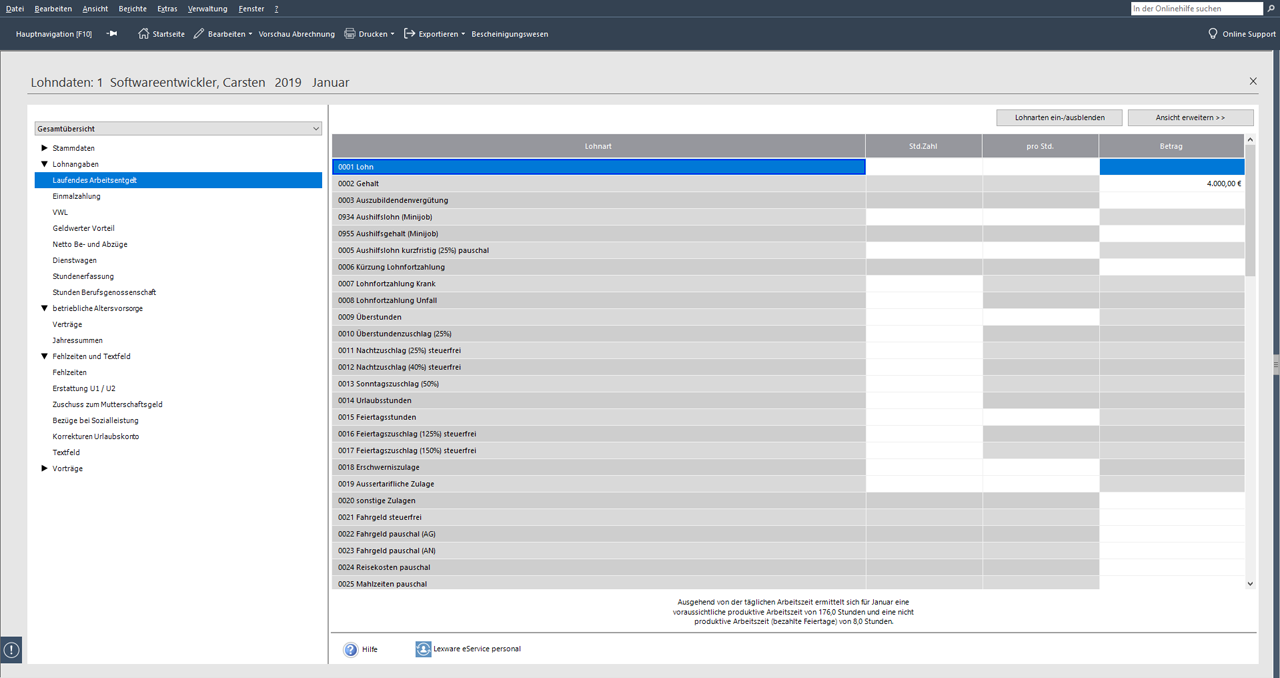

Lexware lohn+gehalt - Screenshot 2  Lexware lohn+gehalt - Screenshot 3

Lexware lohn+gehalt - Screenshot 3

Lexware lohn+gehalt: its rates

Basis

€20.90

/month /user

Pro

€51.90

/month /3 users

Premium

€64.90

/month /5 users

Clients alternatives to Lexware lohn+gehalt

Streamline your payroll process with user-friendly software that handles everything from tax calculations to employee records.

See more details See less details

With intuitive dashboards, automated reporting and 24/7 support, this payroll software is perfect for SMEs looking to save time and reduce errors. Plus, its compliance with UK legislation ensures that your business is always up-to-date with the latest regulations.

Read our analysis about MoorepayBenefits of Moorepay

A complete solution to manage payroll and HR processes

Professional support to ensure compliance and provide advice

Integration and automation to boost efficiency

To Moorepay product page

Streamline your payroll process with powerful software that automates calculations and tax filings.

See more details See less details

With our payroll software, you can easily manage employee information, track time and attendance, and generate reports. Our solution also integrates with accounting software, making it easy to reconcile accounts and process payments. Say goodbye to manual data entry and errors, and hello to a more efficient payroll process.

Read our analysis about PaychexTo Paychex product page

Streamline payroll with automated calculations, tax compliance, and employee self-service portals for efficient workforce management.

See more details See less details

PSSG offers an integrated payroll solution designed to enhance efficiency and accuracy in payroll processing. It features automated calculations that reduce the risk of errors while ensuring compliance with current tax regulations. The user-friendly employee self-service portals allow staff to access pay slips and manage their personal information effortlessly. With robust reporting tools and support for various payment schedules, it is ideal for businesses seeking to optimise their payroll operations.

Read our analysis about PSSGTo PSSG product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.