ActiPaie.fr : Simplify Payroll Management with Advanced Features

ActiPaie.fr: in summary

ActiPaie.fr is designed for businesses of all sizes to streamline payroll processes effortlessly. Tailored for HR professionals and business owners, this software offers intuitive payroll calculations, comprehensive tax management, and powerful reporting tools, making it a standout in payroll software solutions.

What are the main features of ActiPaie.fr?

Automated Payroll Calculations

With ActiPaie.fr, automating complex payroll calculations is straightforward and accurate. Users can rely on the software to handle a range of calculation types efficiently without manual intervention.

- Precision and Accuracy: Achieves precise calculations for allowances, deductions, overtime, and other payroll components.

- Employee Categorisation: Seamlessly manages different categories of employees and their respective pay structures.

- Frequency Flexibility: Supports weekly, bi-weekly, and monthly payroll cycles.

Comprehensive Tax Management

ActiPaie.fr makes tax management simplified and compliant. The software ensures users stay up-to-date with the latest tax regulations and deductions.

- Tax Automation: Automatically calculates and deducts the correct tax amounts for each payroll cycle.

- Regulatory Compliance: Ensures continuous compliance with current tax laws and regulations.

- Customisable Tax Settings: Allows tailor-fit tax settings according to local and regional guidelines.

Detailed Reporting Tools

Gain critical insights into your payroll processes with ActiPaie.fr's intuitive reporting features. Precise and customised reports are just a few clicks away.

- Custom Reports: Create detailed and customisable reports tailored to your business needs.

- Real-Time Data: Access up-to-date information with real-time reporting capabilities.

- Export Options: Export reports in multiple formats, including PDF and Excel, for further analysis or archival purposes.

ActiPaie.fr - newsletter template with your logo

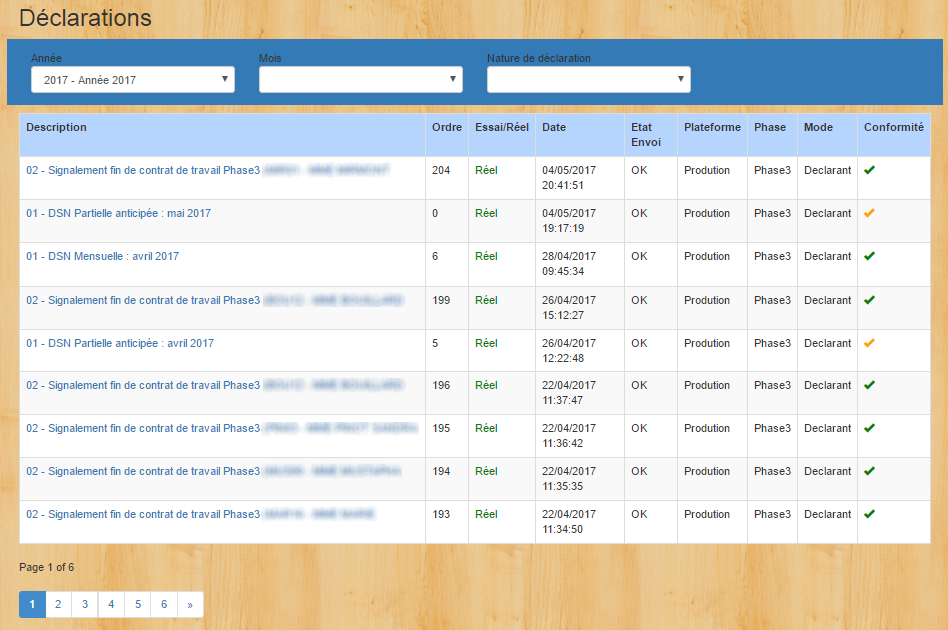

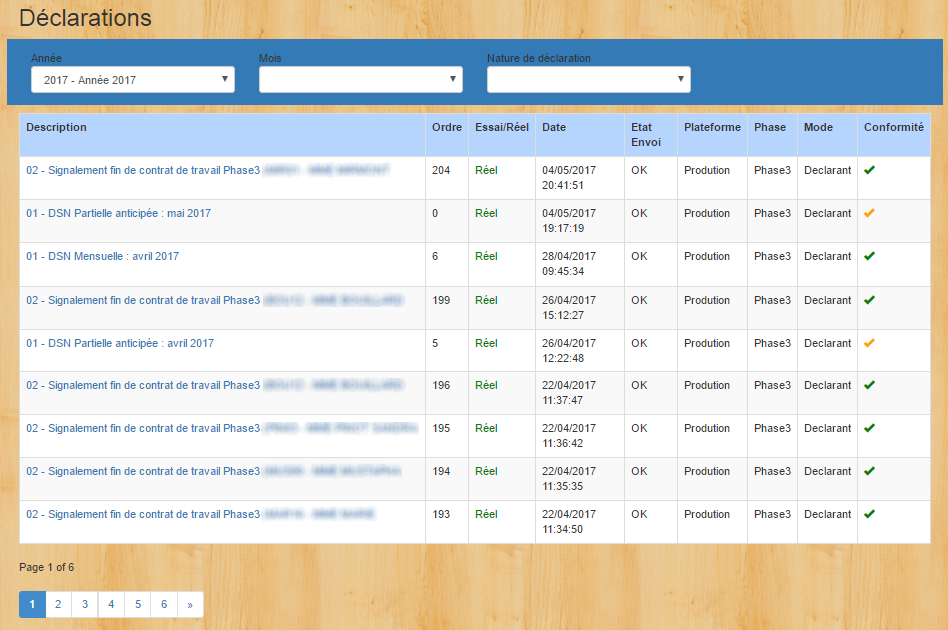

ActiPaie.fr - newsletter template with your logo  ActiPaie.fr - Management statement and DSN Returns

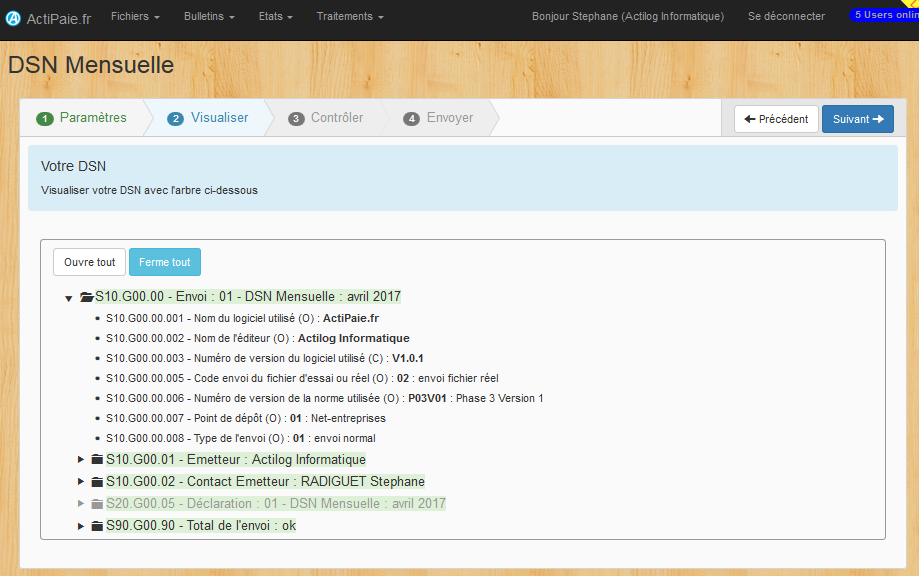

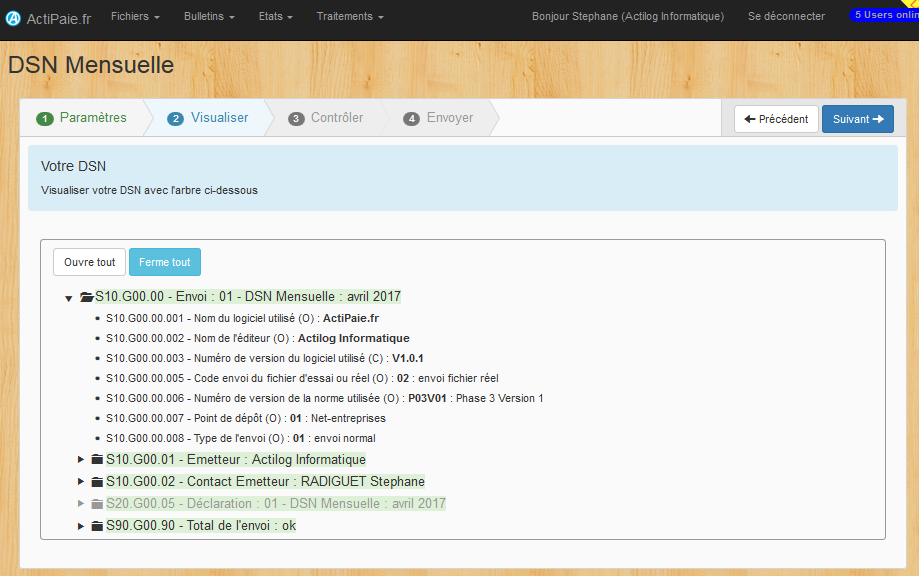

ActiPaie.fr - Management statement and DSN Returns  ActiPaie.fr - Sending your DSN statement with visualization and DSN-VAL control live.

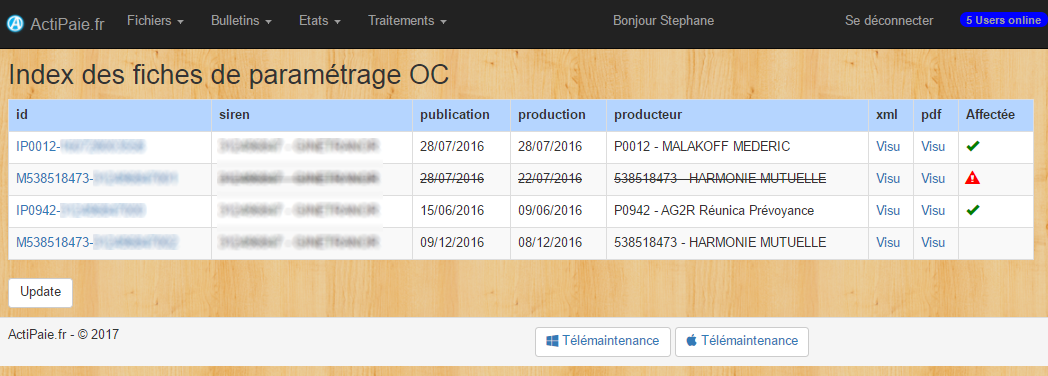

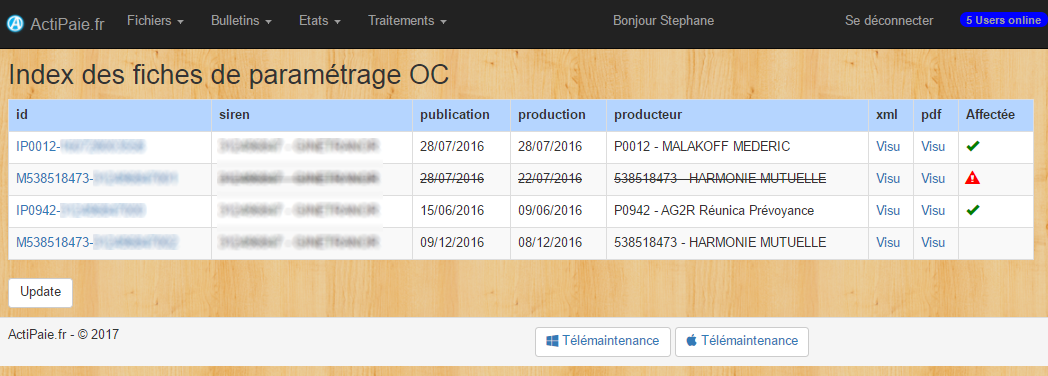

ActiPaie.fr - Sending your DSN statement with visualization and DSN-VAL control live.  ActiPaie.fr - Reception and integration of your setup sheets OC

ActiPaie.fr - Reception and integration of your setup sheets OC

ActiPaie.fr: its rates

Basic

€5.00

/month /unlimited users

Pro

€10.00

/month /unlimited users

Clients alternatives to ActiPaie.fr

Streamline payroll with automated calculations, tax compliance, and employee self-service portals for efficient workforce management.

See more details See less details

PSSG offers an integrated payroll solution designed to enhance efficiency and accuracy in payroll processing. It features automated calculations that reduce the risk of errors while ensuring compliance with current tax regulations. The user-friendly employee self-service portals allow staff to access pay slips and manage their personal information effortlessly. With robust reporting tools and support for various payment schedules, it is ideal for businesses seeking to optimise their payroll operations.

Read our analysis about PSSGTo PSSG product page

Streamline payroll management with this cloud-based software. Automate calculations, create custom reports, and ensure compliance with tax laws.

See more details See less details

Say goodbye to manual payroll processing. With this software, you can easily manage employee information, track time off, and generate payslips. Plus, the system automatically calculates taxes and deductions, so you don't have to worry about errors. Customisable reports make it easy to stay on top of payroll expenses and compliance.

Read our analysis about Fiche-Paie.net | Logiciel paieTo Fiche-Paie.net | Logiciel paie product page

Streamline HR tasks with this cloud-based HRMS software. Manage employee data, payroll, benefits, and attendance efficiently.

See more details See less details

This software automates HR processes, from onboarding to offboarding, and provides comprehensive reporting. With its user-friendly interface and customisable features, it caters to businesses of all sizes. Its security measures ensure data privacy and compliance.

Read our analysis about MultiplierTo Multiplier product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.