Seritus-CoS : Streamlined Compliance Management for Businesses

Seritus-CoS: in summary

Seritus-CoS is designed to simplify compliance management for enterprises, offering robust document control, real-time reporting, and intuitive task automation. It serves compliance officers and businesses aiming to enhance regulatory adherence with efficient and reliable solutions.

What are the main features of Seritus-CoS?

Comprehensive Document Control

Ensure all your compliance documentation is accurately managed and accessible. Seritus-CoS enables users to easily maintain, distribute, and update documents, reducing the risk of non-compliance.

- Centralised document repository

- Version control and tracking

- Automated distribution and updates

Real-time Reporting and Analytics

Gain insights and understand compliance trends through powerful analytics. Seritus-CoS provides real-time reporting tools to help you stay ahead of compliance issues with actionable data.

- Customisable dashboards

- Advanced data filtering options

- Automated compliance alerts

Intuitive Task Automation

Simplify compliance workflows with automation features that reduce manual intervention. Seritus-CoS streamlines repetitive tasks, ensuring more efficient operations and saving time for your team.

- Automated task assignments

- Workflow scheduling and reminders

- Integration with existing business processes

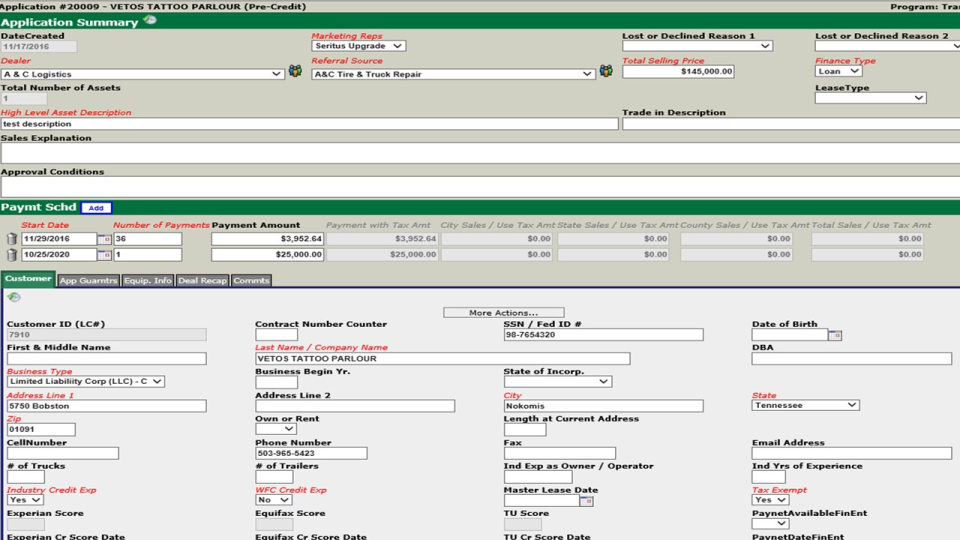

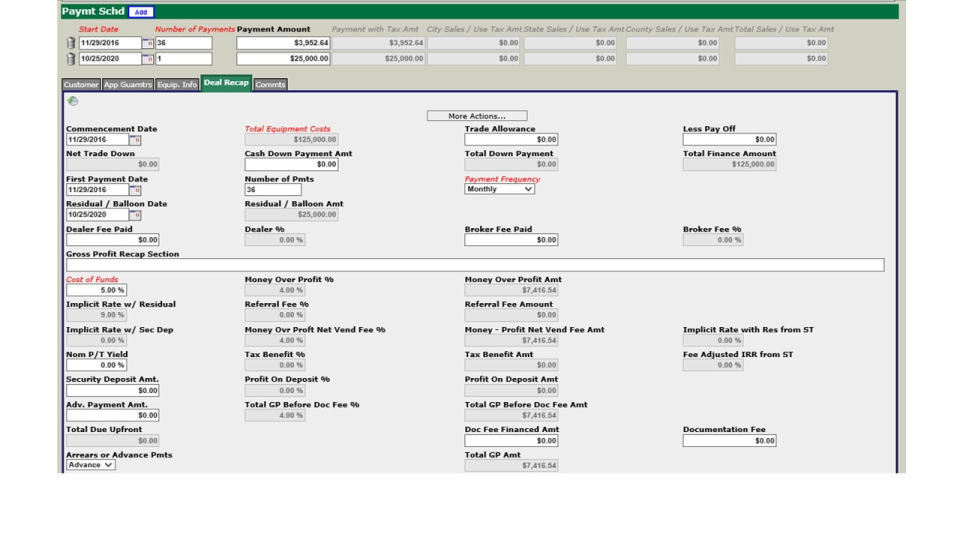

Seritus-CoS - Seritus-CoS-screenshot-0

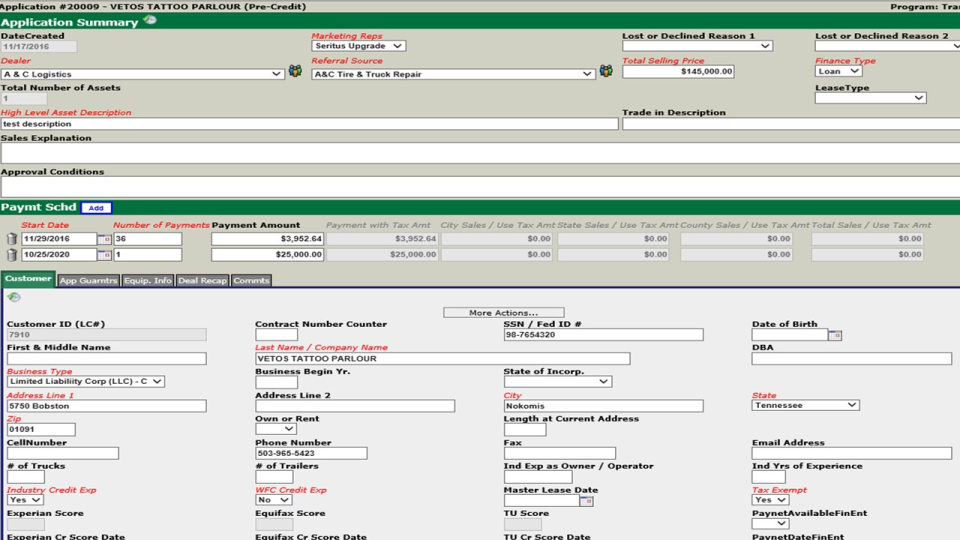

Seritus-CoS - Seritus-CoS-screenshot-0  Seritus-CoS - Seritus-CoS-1-screenshot

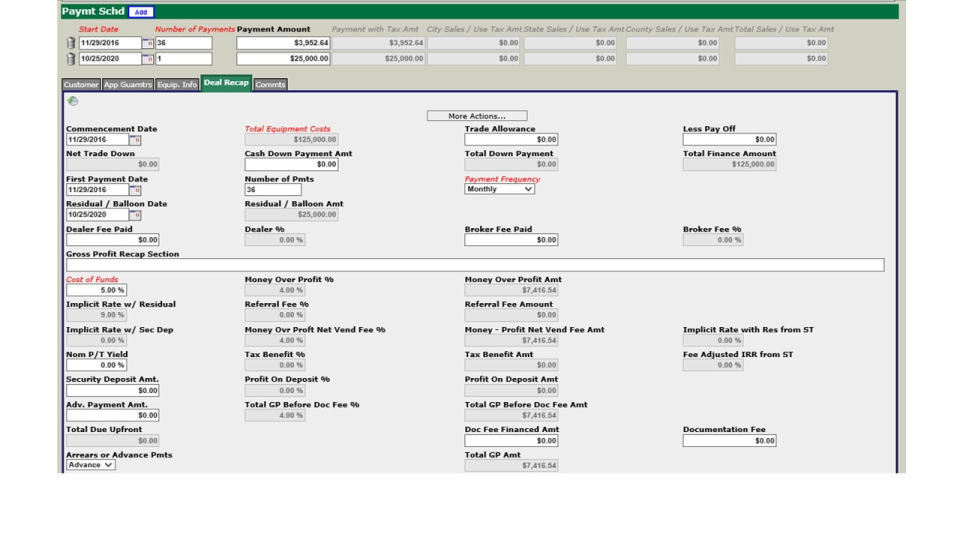

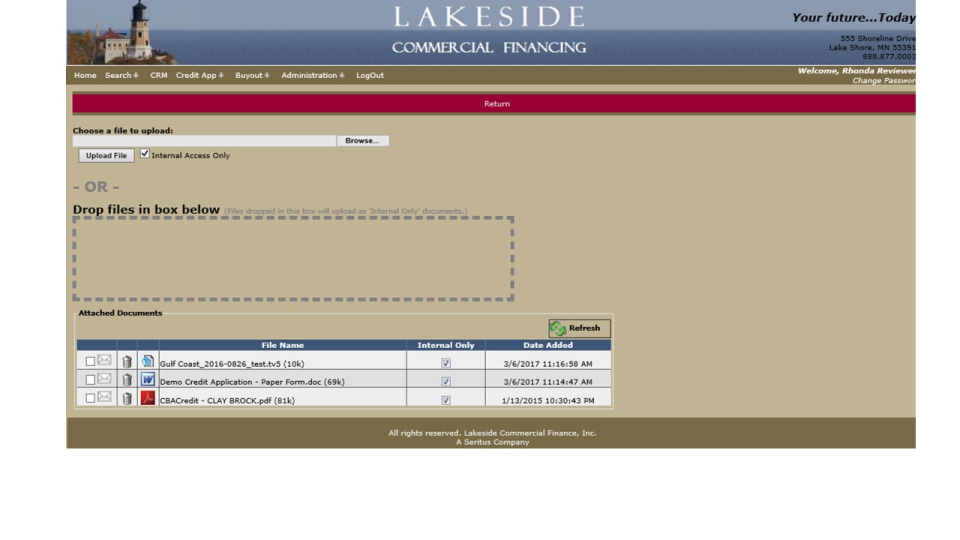

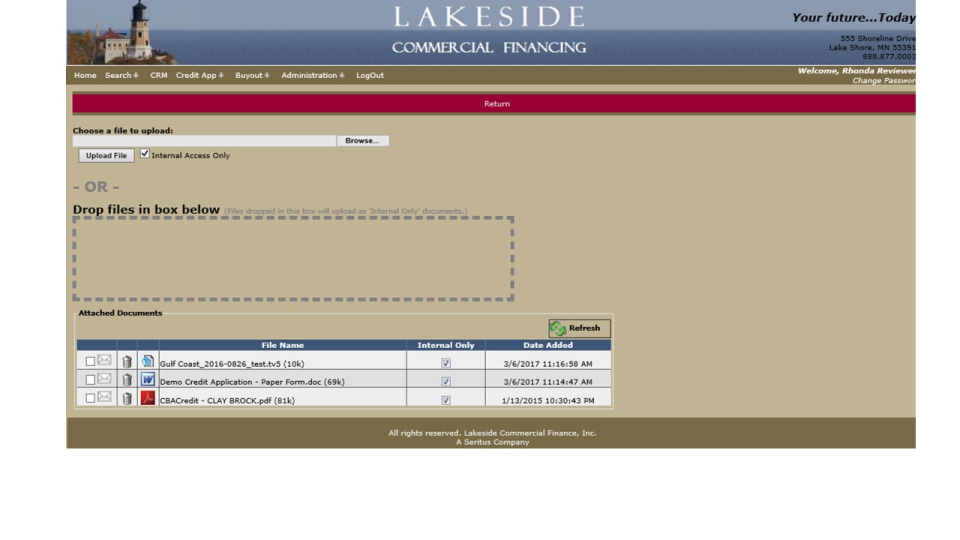

Seritus-CoS - Seritus-CoS-1-screenshot  Seritus-CoS - Seritus-CoS-screenshot-2

Seritus-CoS - Seritus-CoS-screenshot-2  Seritus-CoS - Seritus-CoS-screenshot-3

Seritus-CoS - Seritus-CoS-screenshot-3

Seritus-CoS: its rates

standard

Rate

On demand

Clients alternatives to Seritus-CoS

Automate loan origination process with ease. Reduce time and cost. Streamline borrower data collection, underwriting and closing process.

See more details See less details

Loan Producer makes loan origination simple and fast. It automates the entire process from borrower data collection to underwriting and closing. This software saves time and cost, and streamlines the entire process.

Read our analysis about Loan ProducerTo Loan Producer product page

Automate loan origination with ease. Streamlined workflows, customizable forms and real-time data analytics.

See more details See less details

Digital Back Office simplifies loan origination for lenders. Its intuitive interface and intelligent workflows reduce manual tasks, allowing you to focus on growing your business. Its customizable forms and real-time data analytics provide insights to make informed decisions.

Read our analysis about Digital Back OfficeTo Digital Back Office product page

Streamline loan processes with intuitive workflows, automated applications, and comprehensive reporting tools for effective decision-making.

See more details See less details

Apprivo enhances the loan origination experience by providing intuitive workflows that simplify the application process. With automation features, it reduces manual data entry and expedites approvals. The software also includes robust reporting tools that allow users to track performance metrics and streamline operations. This combination of efficiency and insight makes it an ideal choice for financial institutions looking to optimise their lending practices.

Read our analysis about ApprivoTo Apprivo product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.