Nymbus Core Banking : Next-Gen Core Banking Solutions for Modern Banks

Nymbus Core Banking: in summary

Nymbus Core Banking revolutionises banking operations for financial institutions, offering a streamlined solution for small to large banks. Key features include real-time processing, scalability to support growth, and seamless integration capabilities, distinguishing it from traditional systems.

What are the main features of Nymbus Core Banking?

Real-Time Processing

Boost your bank’s efficiency with Nymbus Core Banking's real-time processing capabilities. This feature ensures that transactions are reflected instantaneously, enhancing customer satisfaction and operational accuracy.

- Instant transaction updates

- Improved customer experience

- Accurate financial records

Scalability and Flexibility

As your business grows, Nymbus Core Banking scales effortlessly, accommodating higher volumes of transactions and customer data. This scalability ensures that your institution remains competitive and prepared for future innovations.

- Seamless capacity expansion

- Accommodates growth in customer base

- Future-proof infrastructure

Seamless Integration

Integrate Nymbus Core Banking effortlessly with your existing systems. The software supports seamless integration with various third-party applications, allowing for enhanced functionality and operational synergy.

- Easy connectivity with third-party services

- Enhanced operational efficiency

- Reduced IT complexities

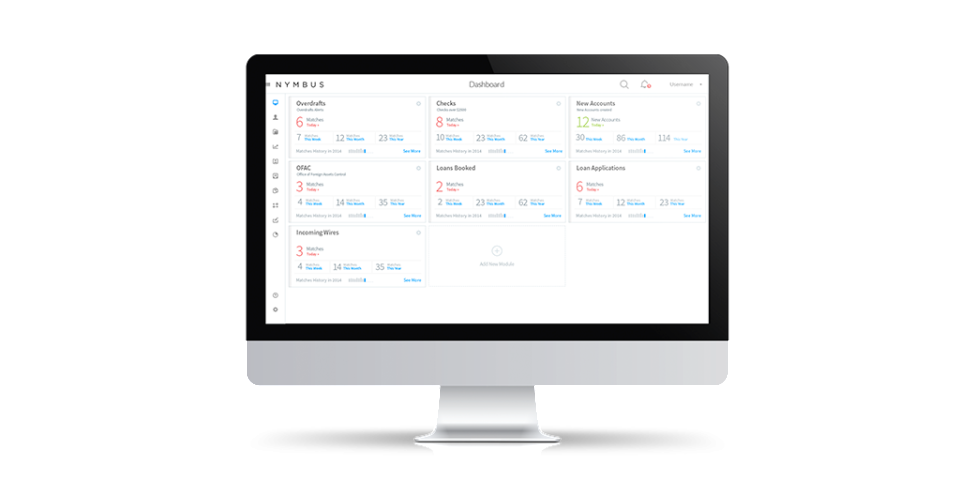

Nymbus Core Banking - Nymbus Core Banking-screenshot-0

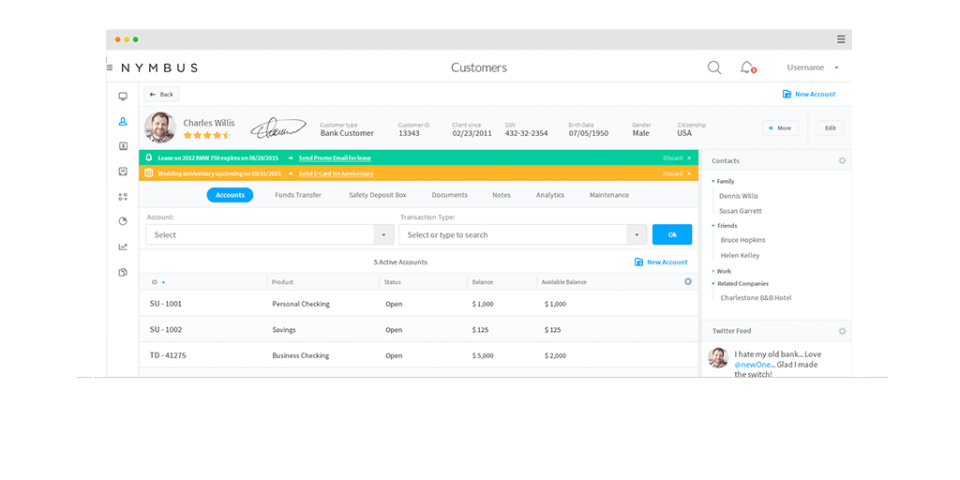

Nymbus Core Banking - Nymbus Core Banking-screenshot-0  Nymbus Core Banking - Nymbus Core Banking-screenshot-1

Nymbus Core Banking - Nymbus Core Banking-screenshot-1  Nymbus Core Banking - Nymbus Core Banking-screenshot-2

Nymbus Core Banking - Nymbus Core Banking-screenshot-2

Nymbus Core Banking: its rates

standard

Rate

On demand

Clients alternatives to Nymbus Core Banking

Streamline banking operations with our software. Automate transactions, manage accounts, and improve customer experience.

See more details See less details

Our banking systems software, iCBS, offers a comprehensive solution for financial institutions. With its advanced automation features, iCBS simplifies transactional processes and improves the accuracy of account management. Additionally, it enables banks to offer a seamless customer experience by providing real-time updates on account activity and balances.

Read our analysis about iCBSTo iCBS product page

A banking system software that streamlines financial operations, enhances customer experience, and improves risk management.

See more details See less details

With its advanced automation and analytics tools, this software enables banks to reduce operational costs, increase revenue, and comply with regulatory requirements. Its modular design allows for easy integration with existing systems, while its open architecture ensures flexibility and scalability.

Read our analysis about iMALTo iMAL product page

Streamline banking operations and enhance customer experience with a comprehensive banking system software.

See more details See less details

Infocorp Banking Platform offers features such as core banking, loan management, digital banking, and analytics to improve efficiency and provide a seamless banking experience to customers. With its modular architecture, the software can be easily customized to meet specific business needs.

Read our analysis about Infocorp Banking PlatformTo Infocorp Banking Platform product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.