plenigo : Cloud-based Subscription Management

plenigo: in summary

Modern publishers use plenigo to manage their subscription business for digital and print products. The software-as-a-service platform contains all the functions you need to successfully implement digital business models.

- Access Management: Ensure that only authorised users see your content. With plenigo you can flexibly manage and control registrations, logins, users and their access rights.

- Subscription Management: With plenigo, every conceivable supply model can be depicted – for digital and print products. Combine different products into offers of any duration for optimal exploitation. Control and manage your subscriptions, upgrades and downgrades, renewals and cancellations fully automated.

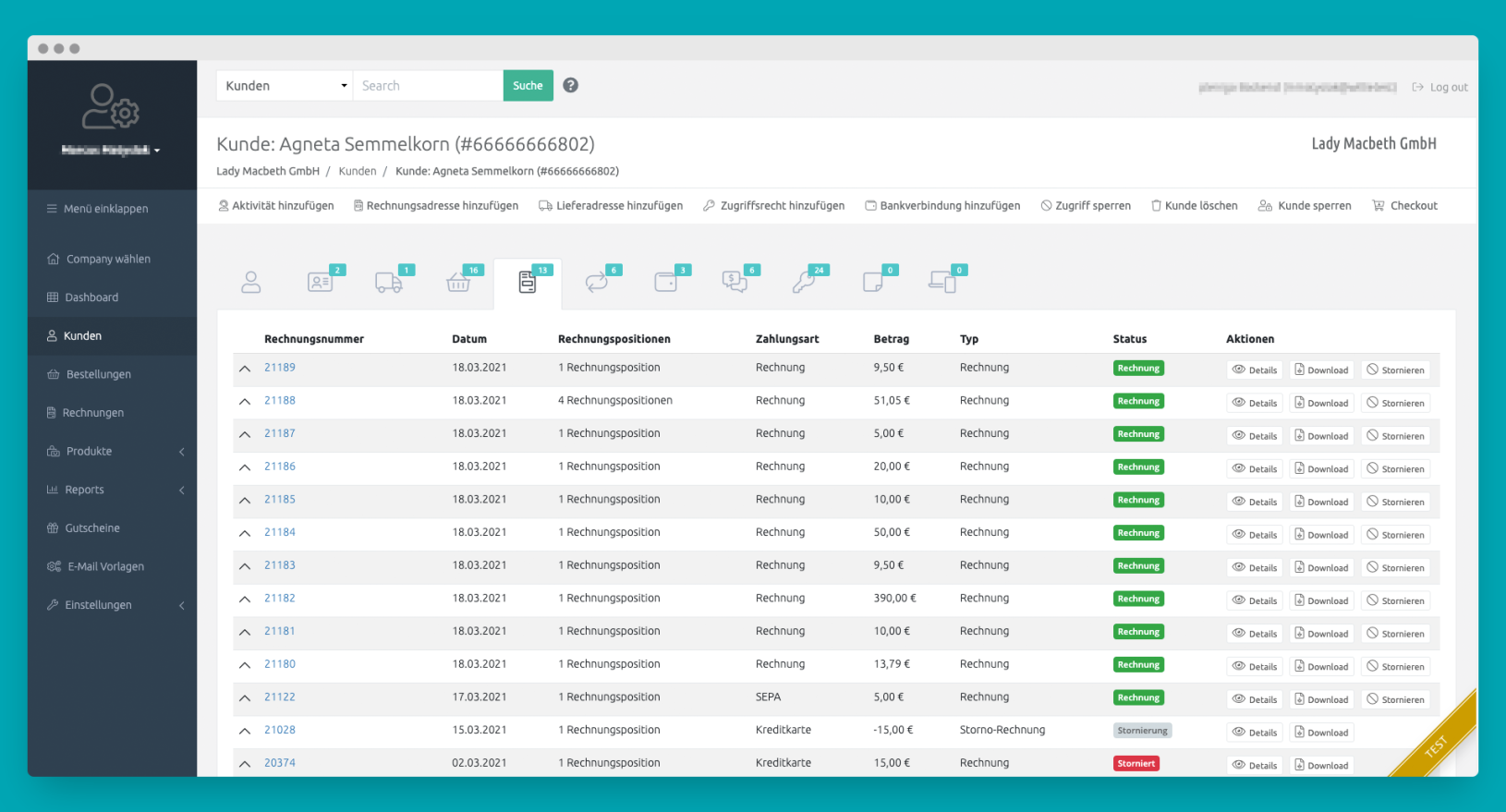

- Billing: Set up your workflows for recurring payments and automate the logics of invoicing – whether one-off, periodic, pro-rata or consumption-based. You concentrate on building your subscription business, plenigo controls your invoicing workflows and automatically delivers factually correct invoices by mail, post or download.

- Recurring Payment: Payment transactions are a matter of trust. The integrated payment gateways of many major providers ensure that your payments are processed quickly and reliably. With flexible tax schemes, over 180 currencies and all common payment methods, all markets and target groups are at your fingertips.

Its benefits

Subscription Management

Billing Automation

Recurring Payment

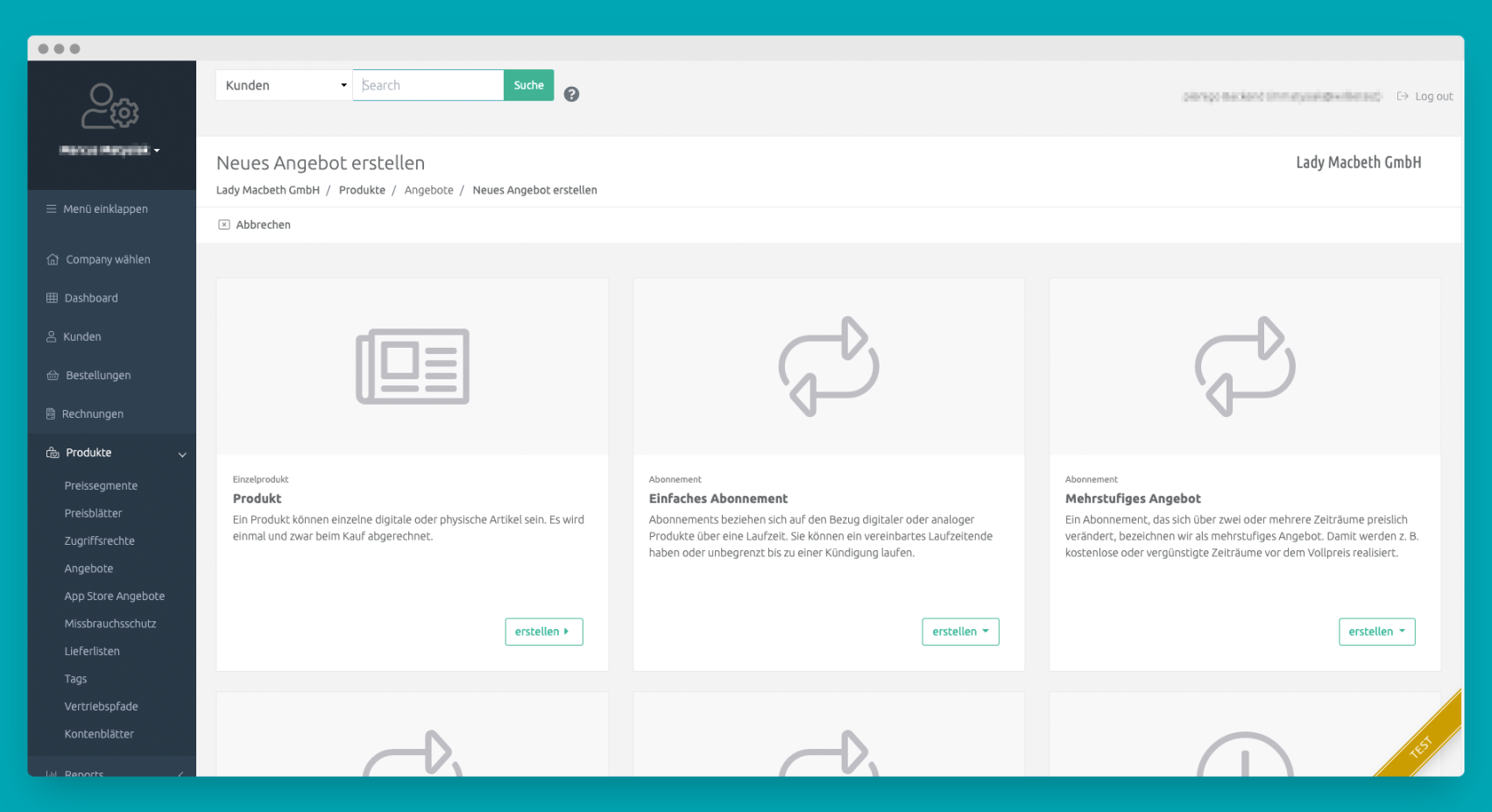

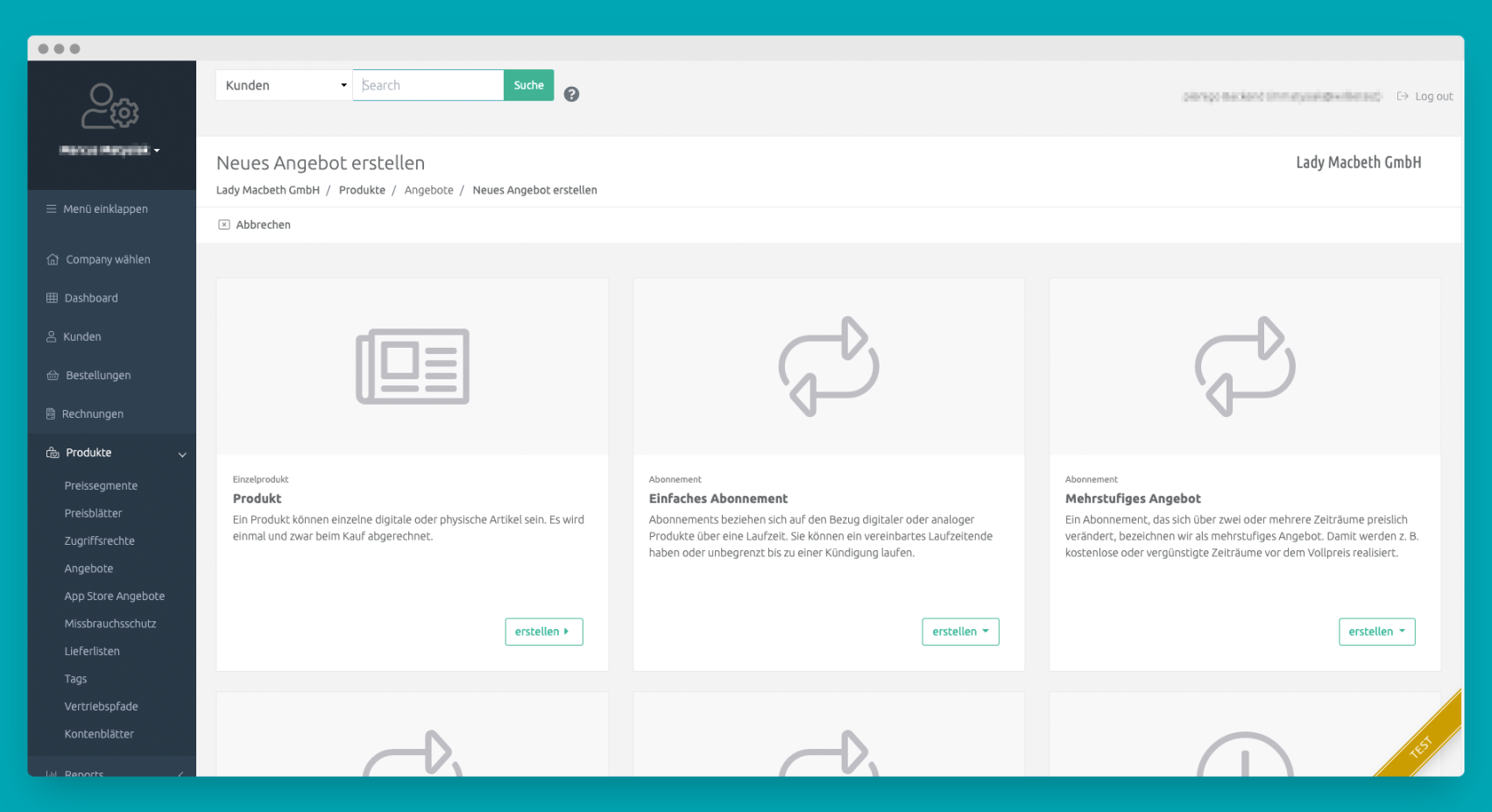

plenigo - Create a wide variety of offers, such as a simple product, different levels of subscriptions, time passes, and much more.

plenigo - Create a wide variety of offers, such as a simple product, different levels of subscriptions, time passes, and much more.  plenigo - Keep an overview of your different offers.

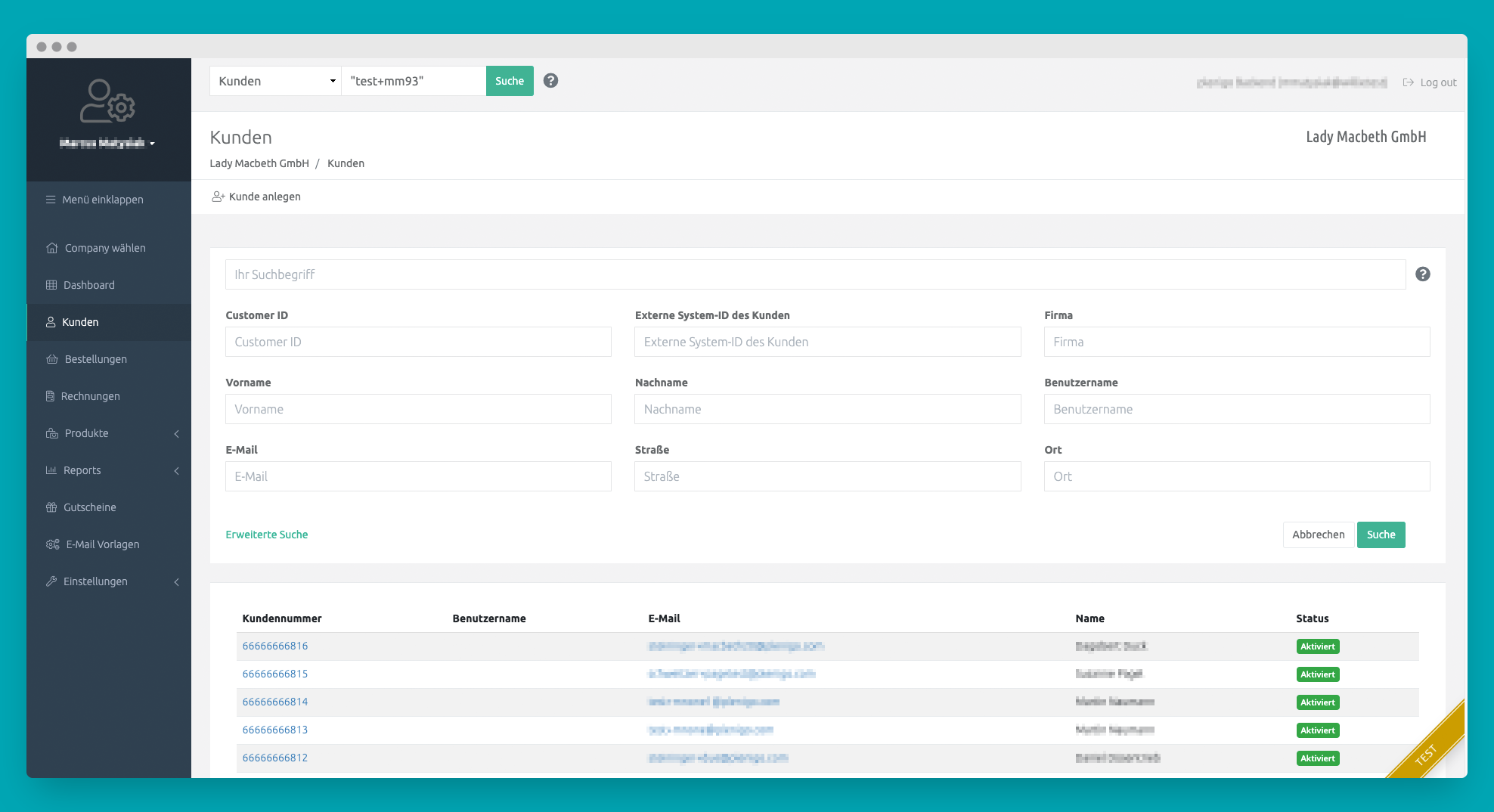

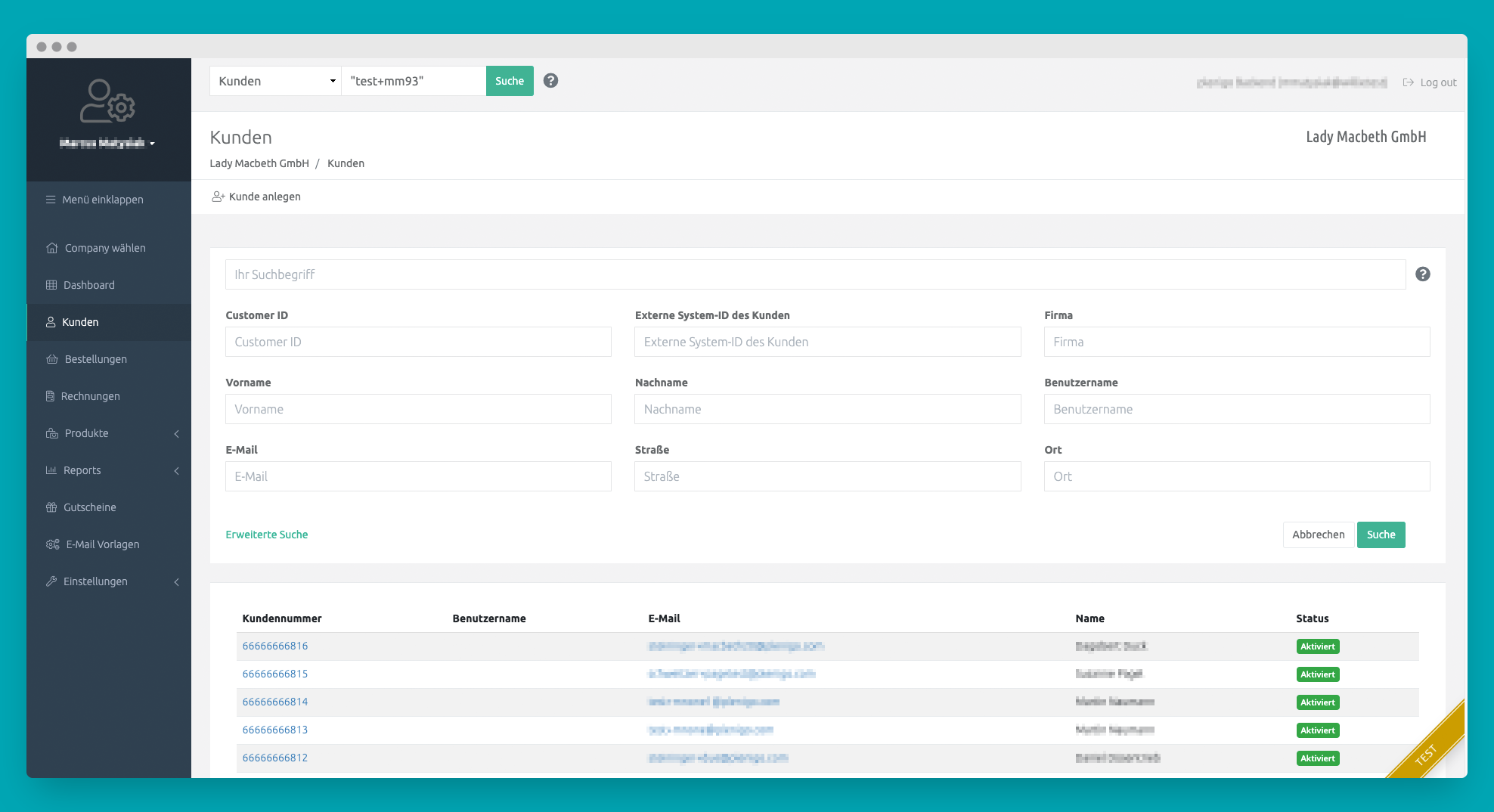

plenigo - Keep an overview of your different offers.  plenigo - So findet Ihr Kundenservice ganz einfach Ihre Kunden.

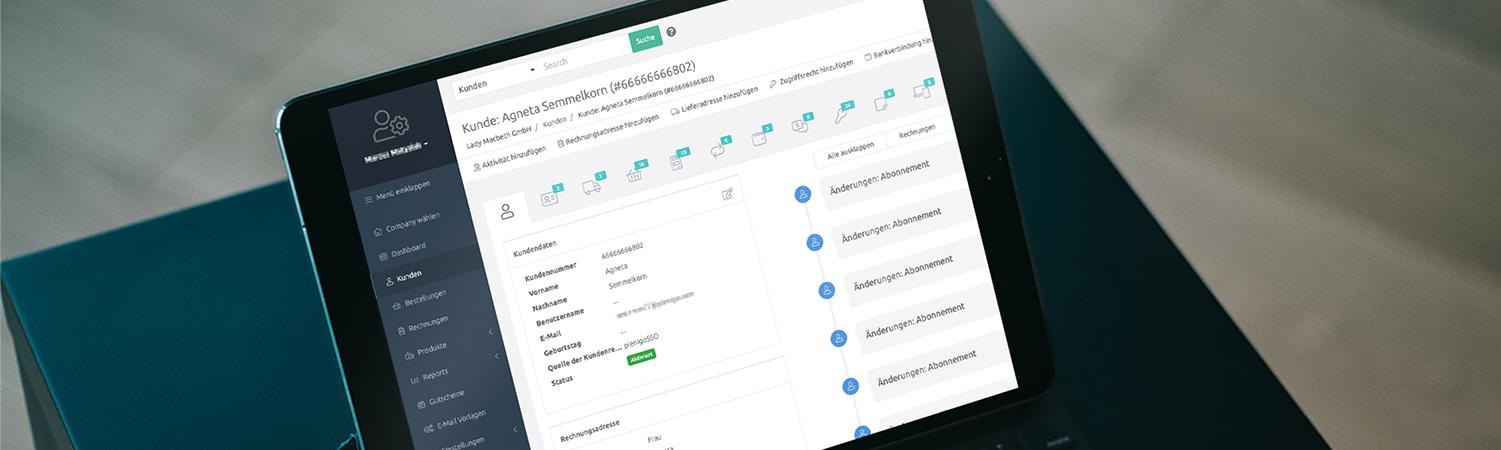

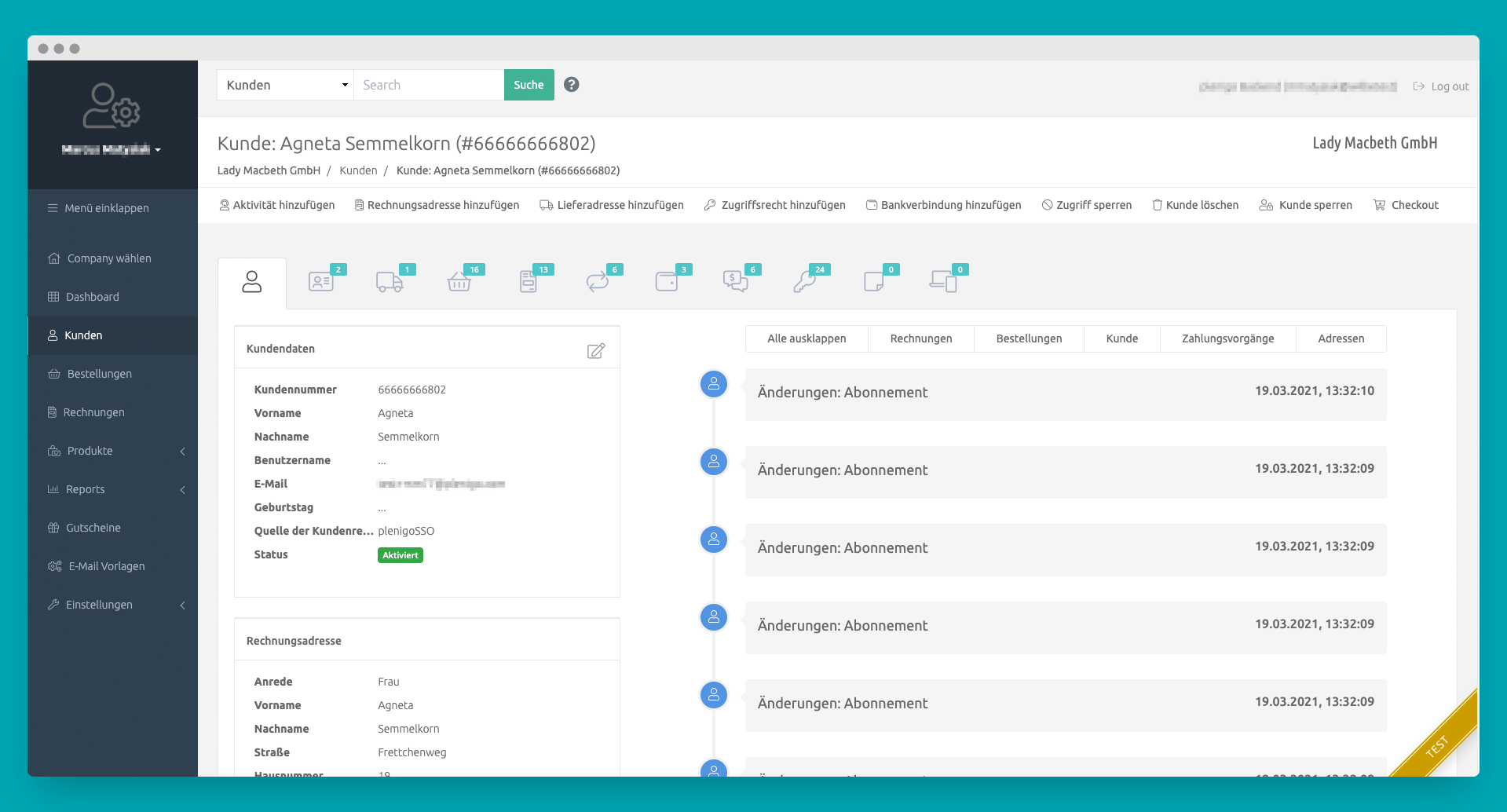

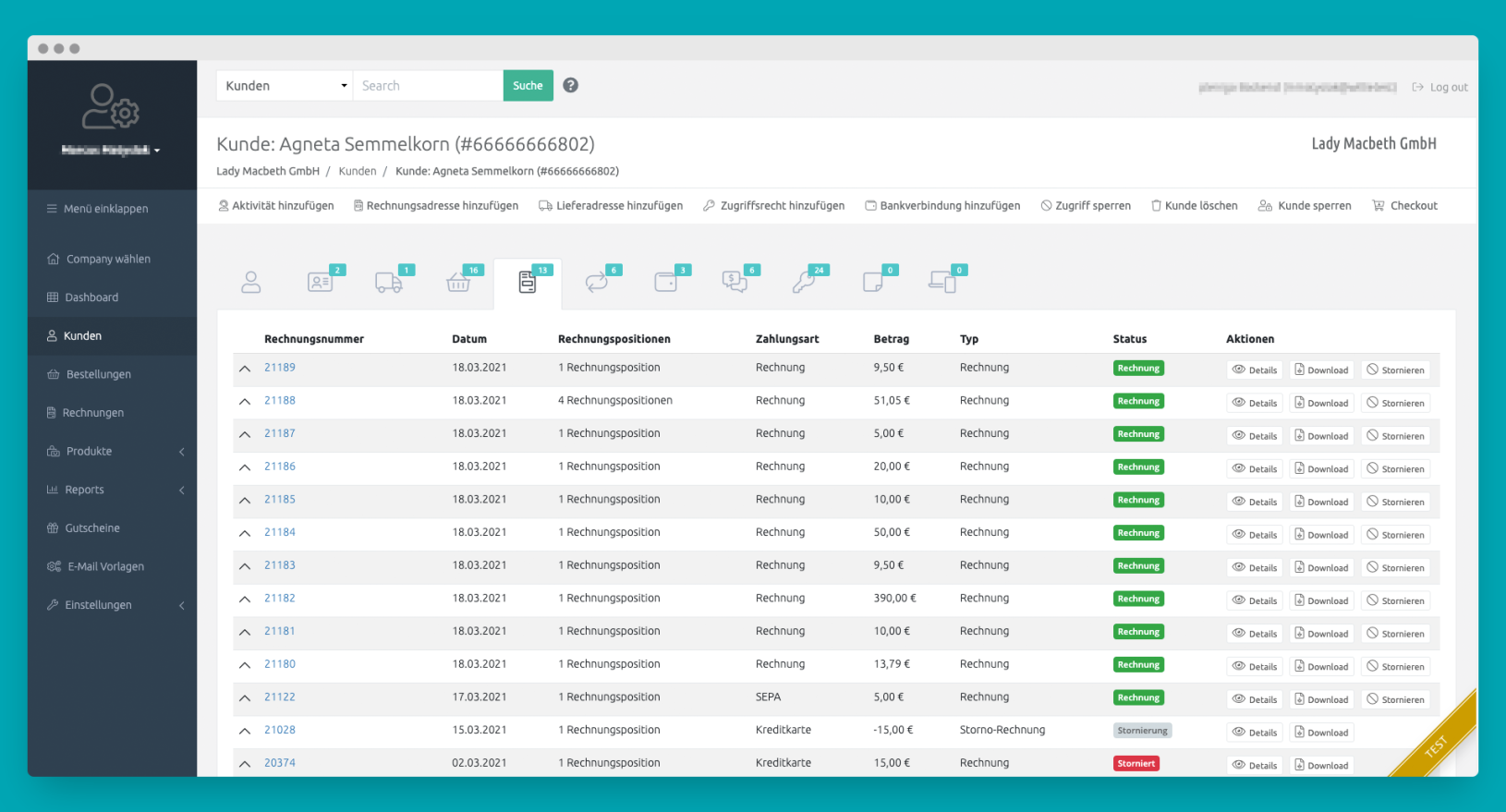

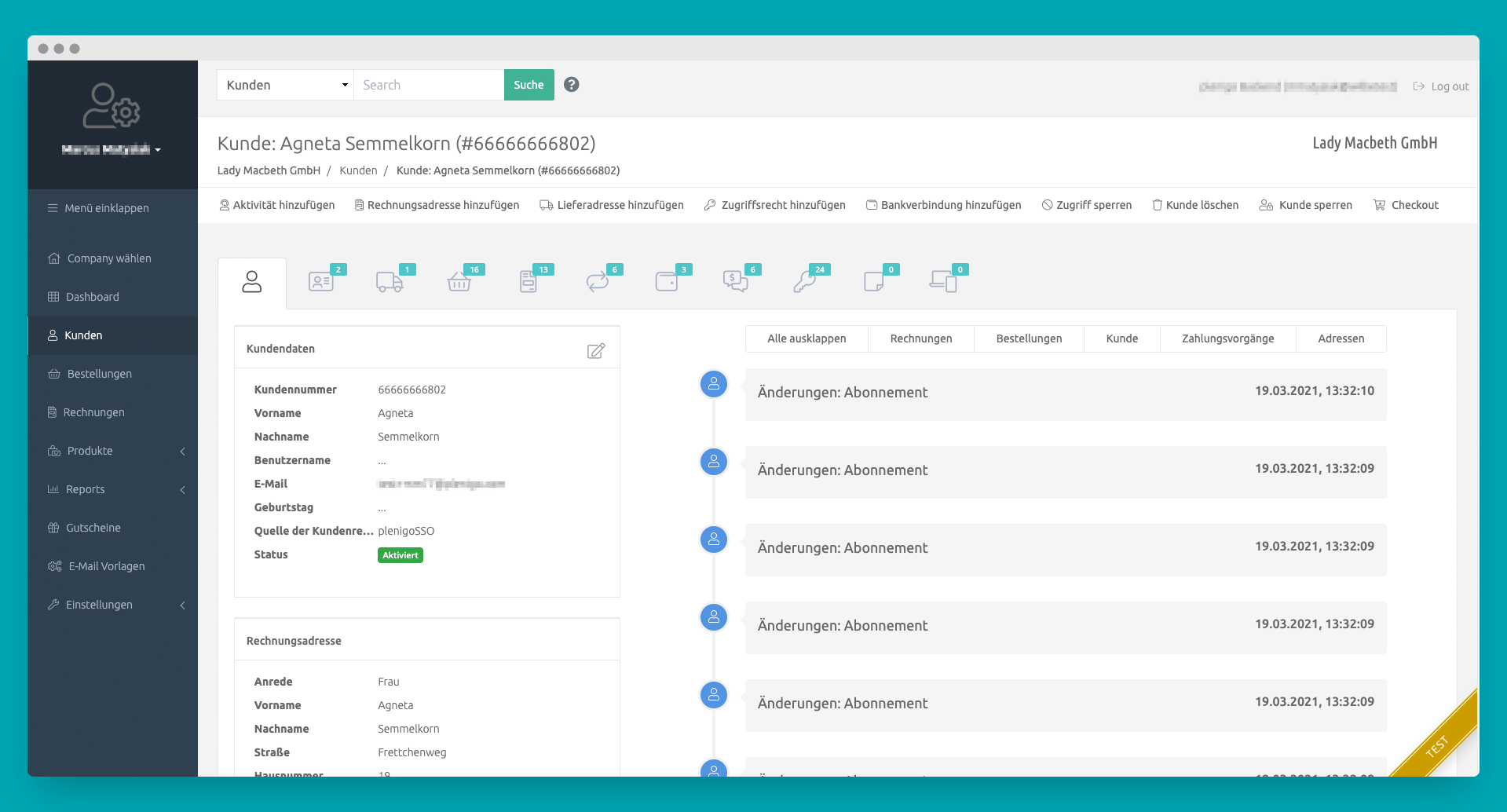

plenigo - So findet Ihr Kundenservice ganz einfach Ihre Kunden.  plenigo - The customer cockpit gives your customer service a 360° view of every customer.

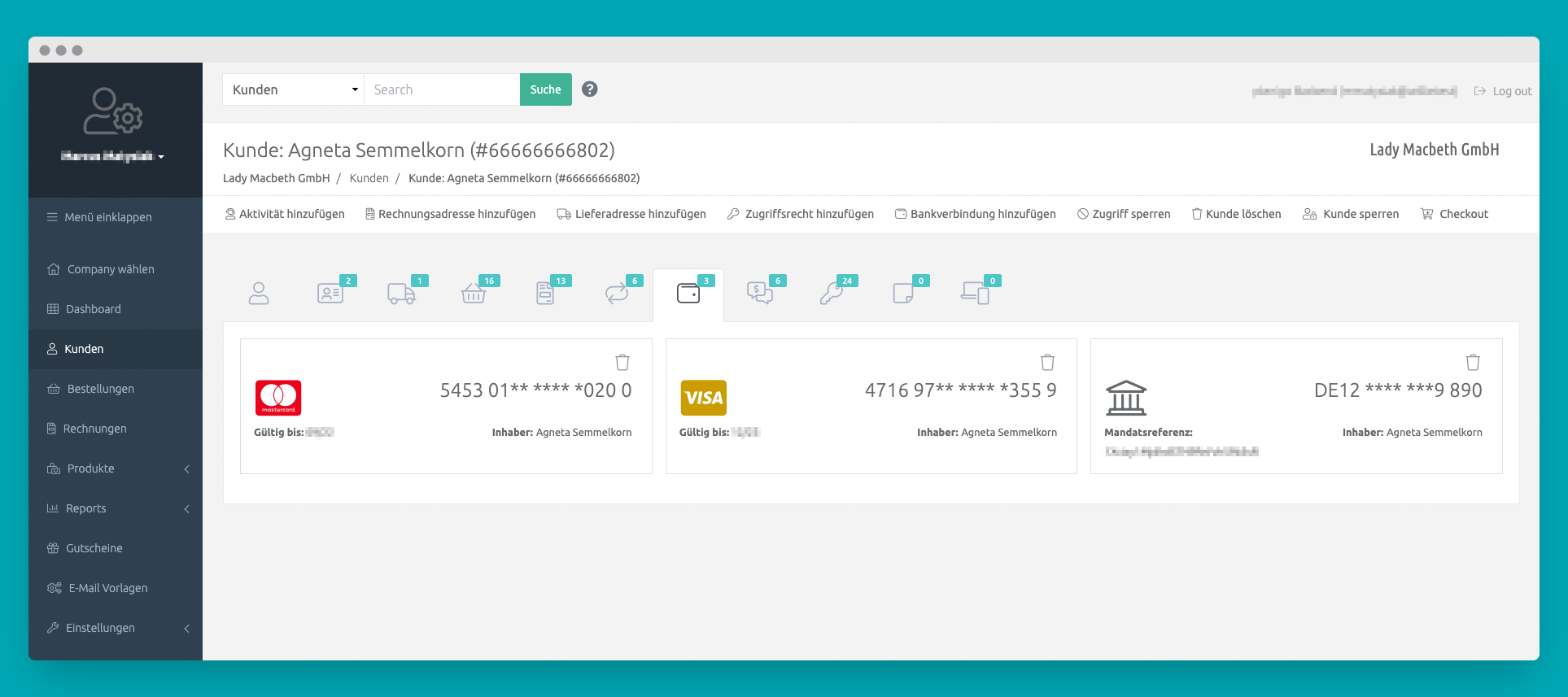

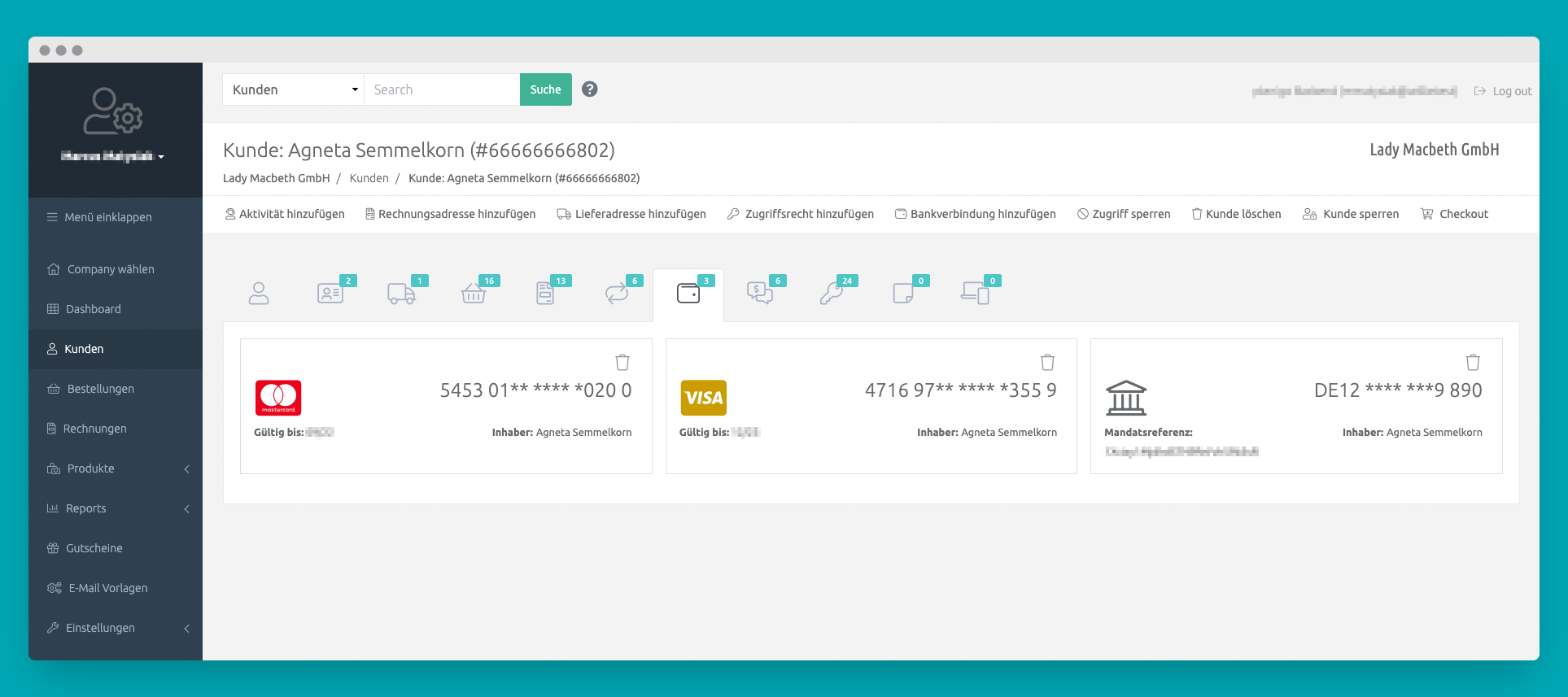

plenigo - The customer cockpit gives your customer service a 360° view of every customer.  plenigo - Overview of your customers' means of payment.

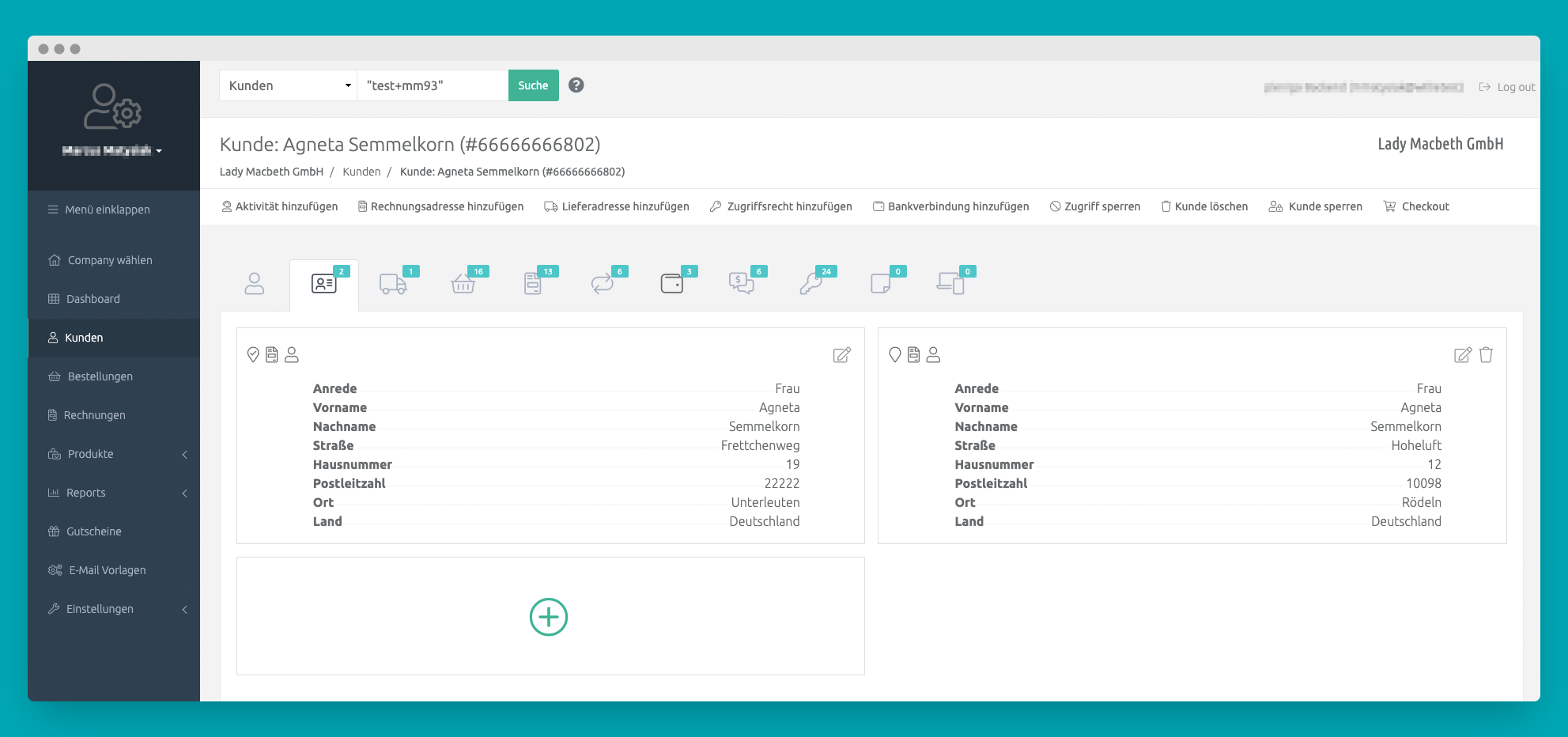

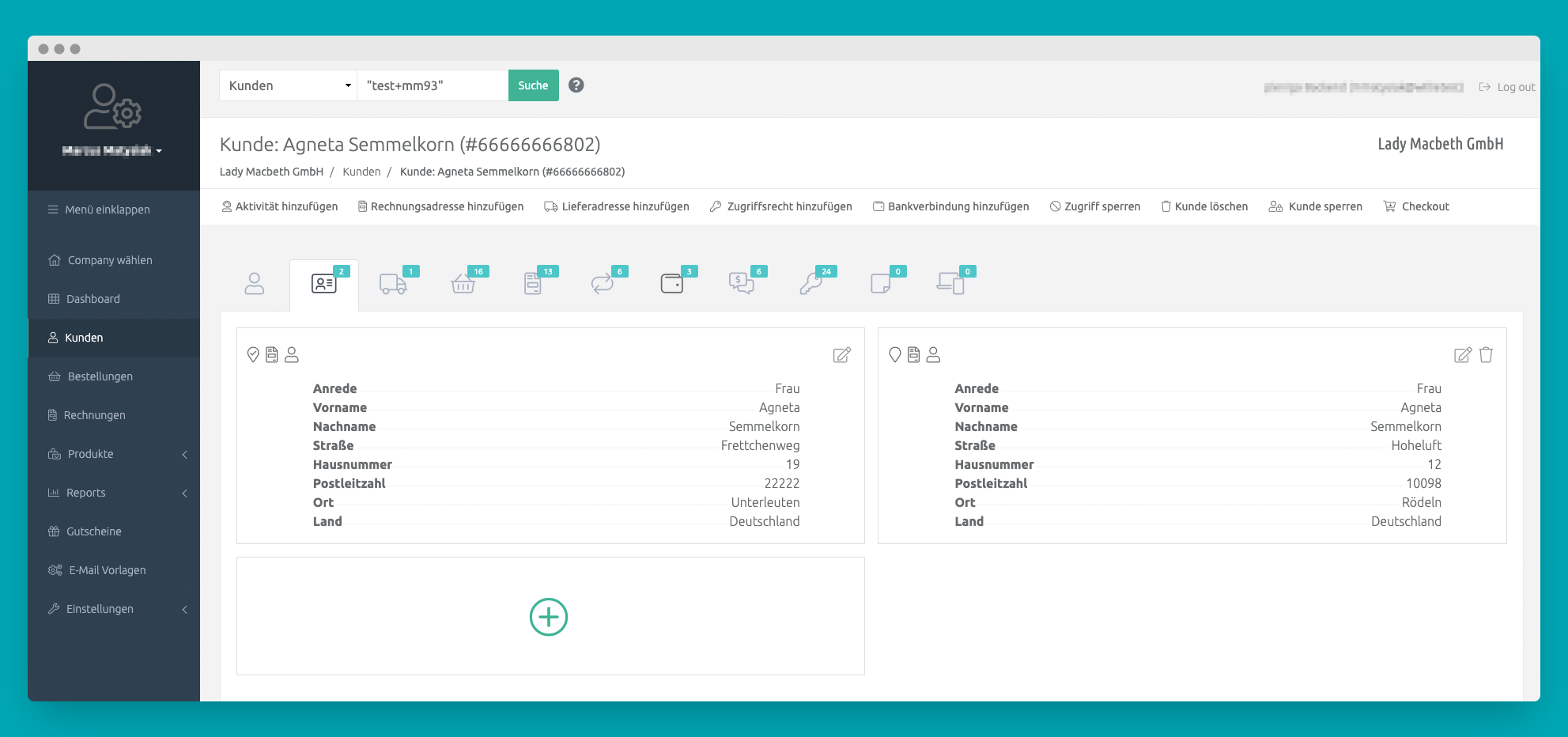

plenigo - Overview of your customers' means of payment.  plenigo - All addresses of every customer at a glance.

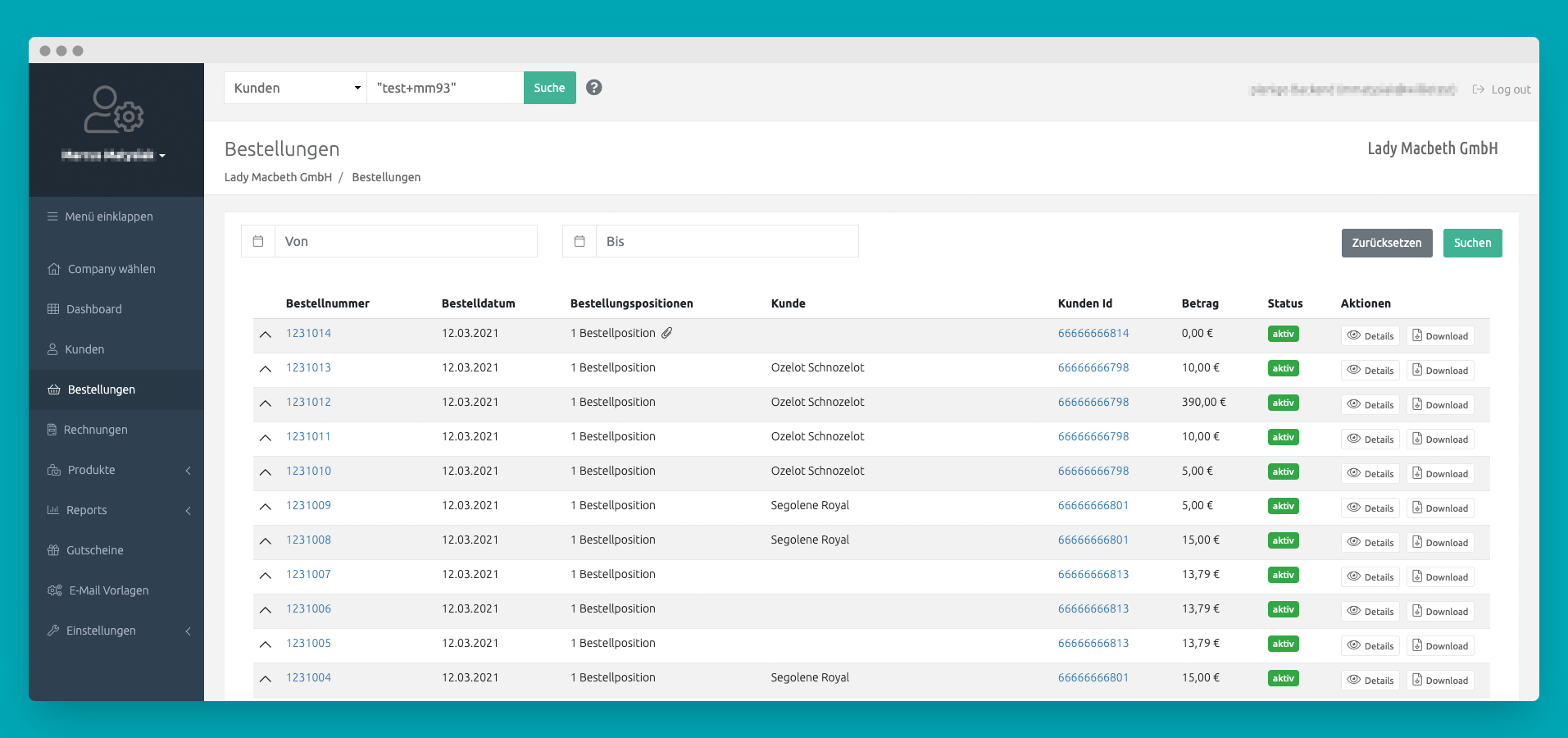

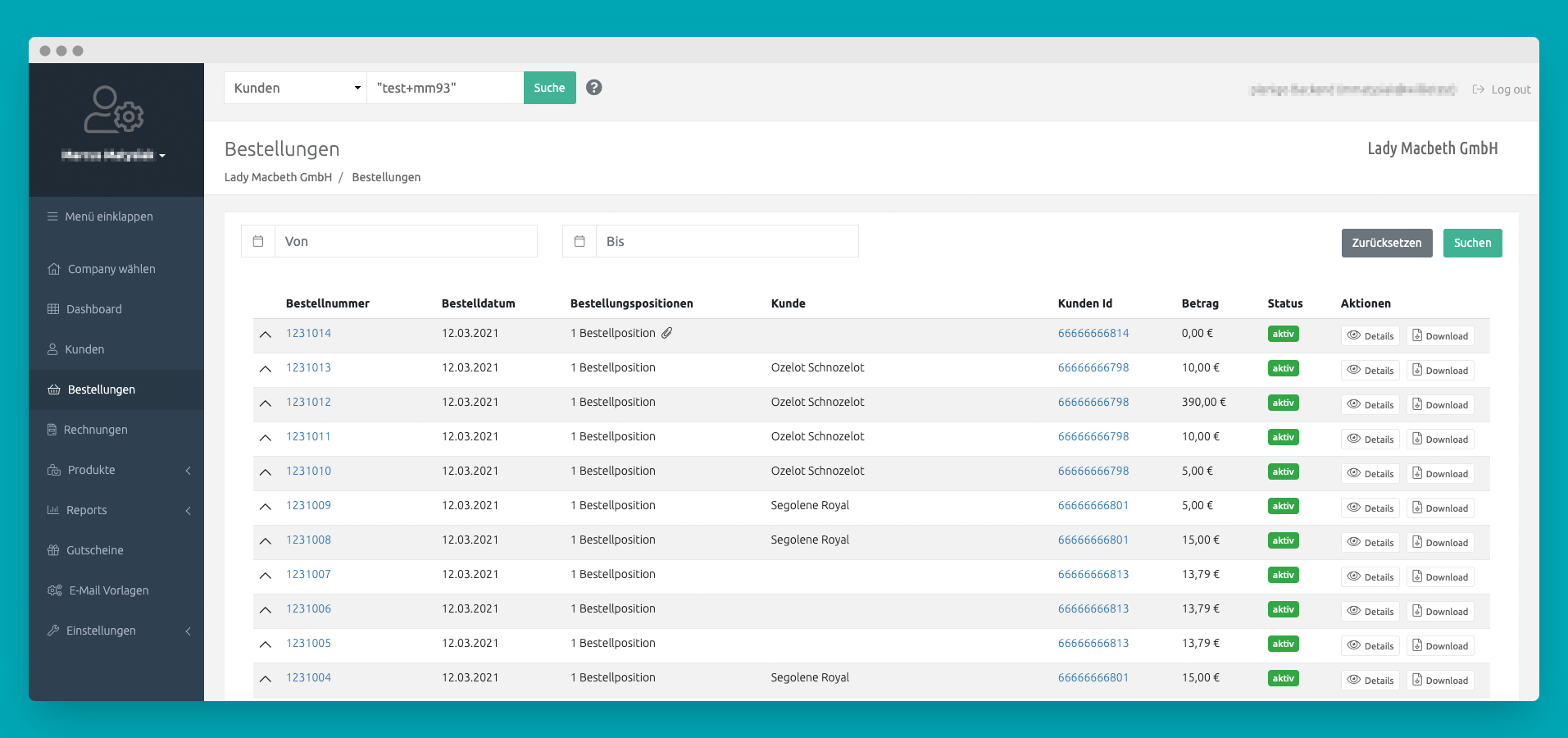

plenigo - All addresses of every customer at a glance.  plenigo - Keep track of orders received.

plenigo - Keep track of orders received.

plenigo: its rates

Standard

€99.00

/month /unlimited users

Clients alternatives to plenigo

Global money transfers, multi-currency accounts, and seamless payment solutions for businesses of all sizes.

See more details See less details

Airwallex offers comprehensive features, including global money transfers in multiple currencies, allowing businesses to engage in cross-border transactions with ease. It provides multi-currency accounts, enabling users to hold and manage funds in various currencies without unnecessary conversion fees. With its seamless payment solutions tailored for various business needs, Airwallex empowers companies to streamline their financial operations and enhance customer experiences efficiently.

Read our analysis about AirwallexTo Airwallex product page

Streamlined payment processing, user-friendly interface, and secure transactions make this business card software ideal for managing payments efficiently.

See more details See less details

Takepayments offers a streamlined payment processing solution that enhances efficiency for businesses. Its user-friendly interface ensures easy navigation, while the software prioritises secure transactions to protect sensitive customer information. With features designed to simplify payment management, it caters perfectly to businesses seeking a reliable way to handle monetary transactions seamlessly. Ideal for both small enterprises and larger organisations, it aims to optimise cash flow and improve customer experiences.

Read our analysis about takepaymentsTo takepayments product page

Create and share customised digital business cards effortlessly, manage contacts seamlessly, and analyse engagement metrics to maximise networking opportunities.

See more details See less details

This software offers users the ability to design and distribute personalised digital business cards with ease, ensuring a professional touch in networking situations. Features include seamless contact management to keep information organised and an analytics function that enables users to track engagement rates of their cards. This comprehensive approach not only enhances visibility but also helps in refining networking strategies based on real-time data insights.

Read our analysis about TideTo Tide product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.