VisionCredit Fintech : Innovative Lending and Credit Management Software

VisionCredit Fintech: in summary

VisionCredit Fintech revolutionises lending with advanced analytics and seamless integrations for financial institutions. This cutting-edge software is designed for banks, credit unions, and other financial entities to efficiently manage credit processes with features like automated risk assessment and customisable dashboards.

What are the main features of VisionCredit Fintech?

Automated Risk Assessment

Streamline your credit evaluation process with VisionCredit's automated risk assessment feature. Utilising AI technology and real-time analytics, it offers precise credit risk insights, reducing errors and enhancing decision-making efficiency.

- AI-driven credit scoring

- Real-time data analysis

- Predictive modelling capabilities

Customisable Dashboards

Gain a comprehensive overview of your lending operations with customisable dashboards that provide insights and statistics tailored to your needs. The flexibility allows users to focus on critical metrics and streamline workflow.

- Intuitive drag-and-drop interface

- Integration with existing data sources

- Real-time updates and alerts

Integrated Loan Processing

Enhance your lending strategy with VisionCredit's integrated loan processing feature. This all-in-one system manages the entire loan lifecycle efficiently, from origination to repayment, saving time and resources.

- End-to-end loan management

- Seamless application tracking

- Automated documentation and compliance checks

Its benefits

GDPR

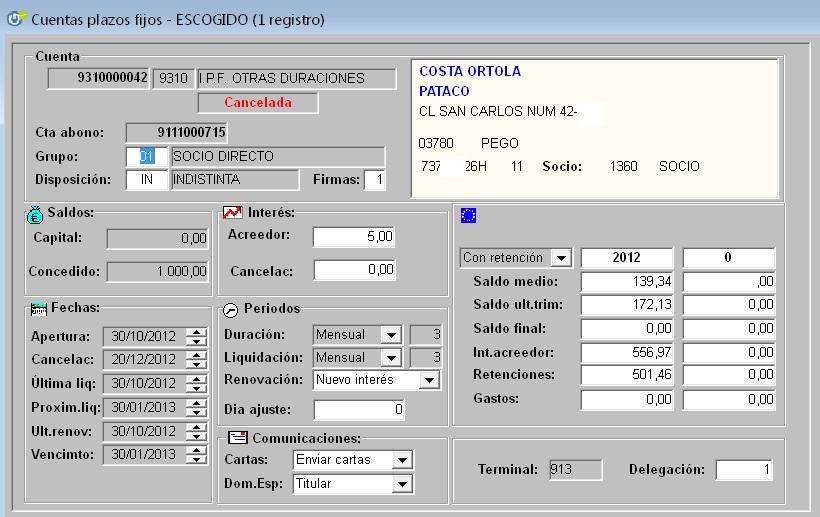

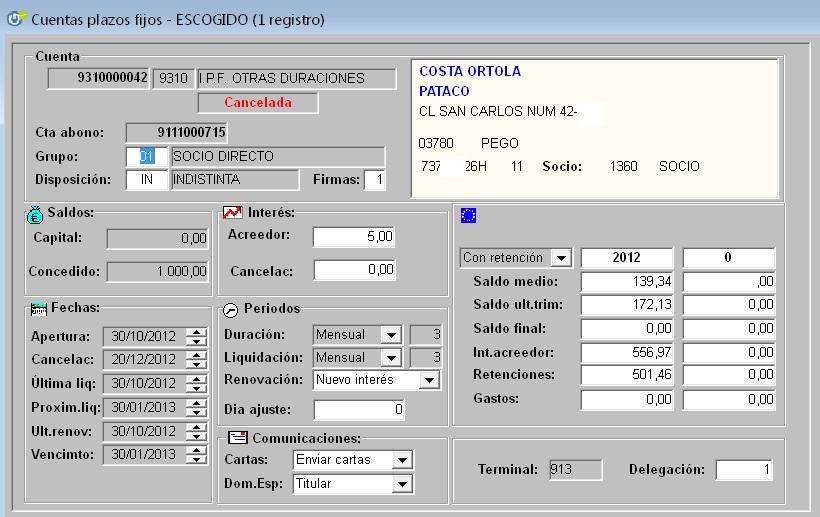

VisionCredit Fintech - Screenshot 1

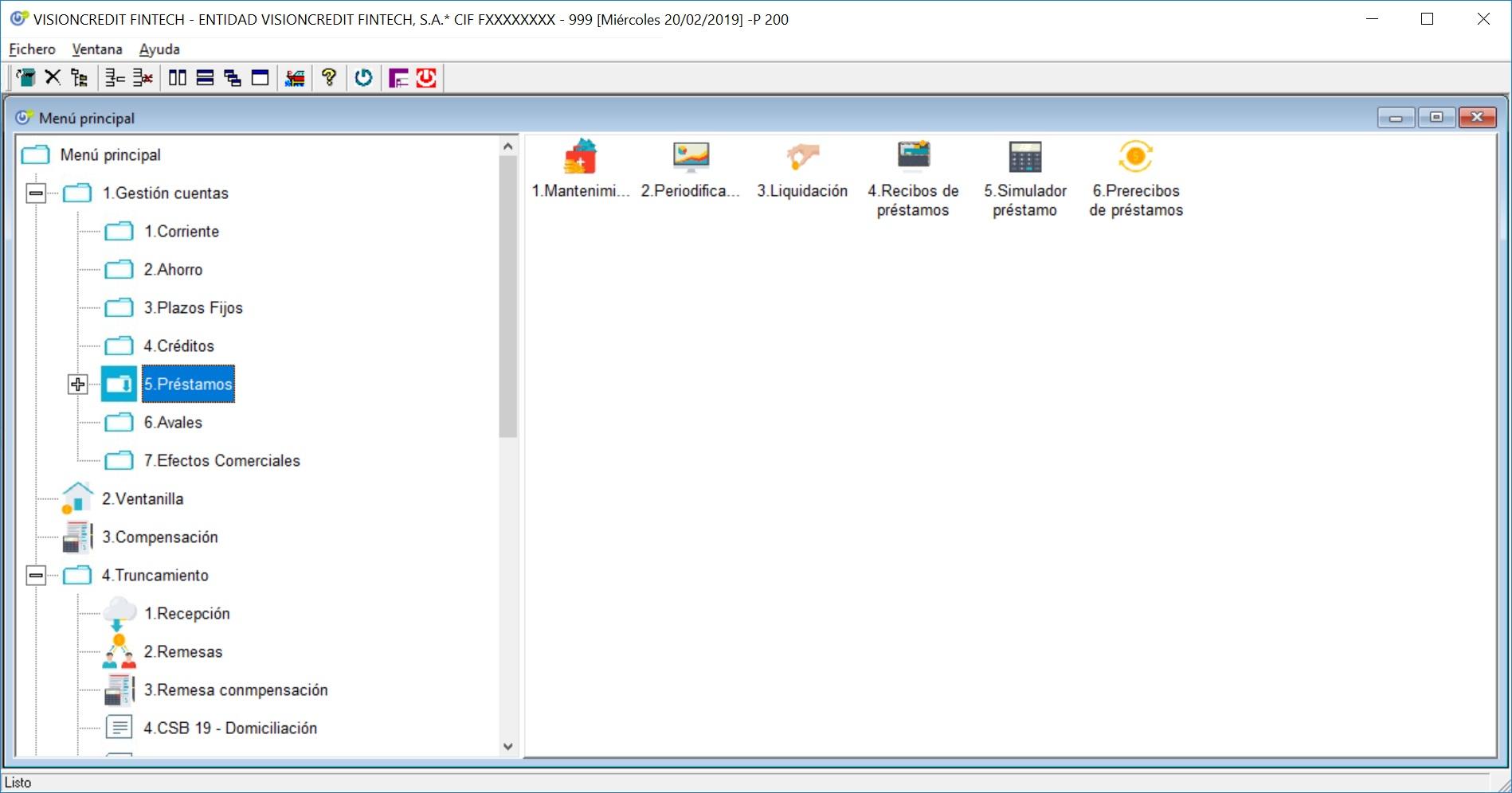

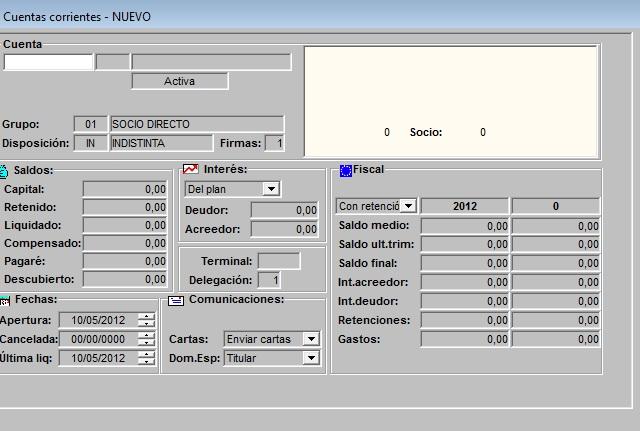

VisionCredit Fintech - Screenshot 1  VisionCredit Fintech - Screenshot 2

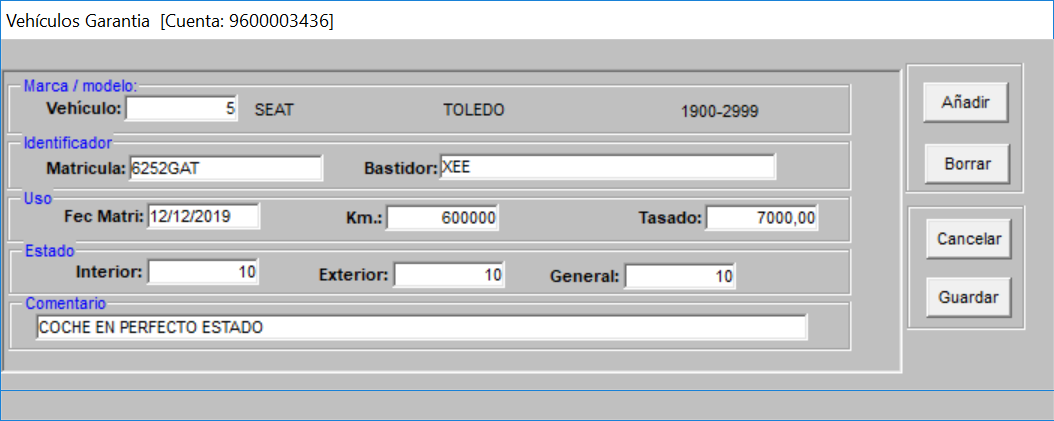

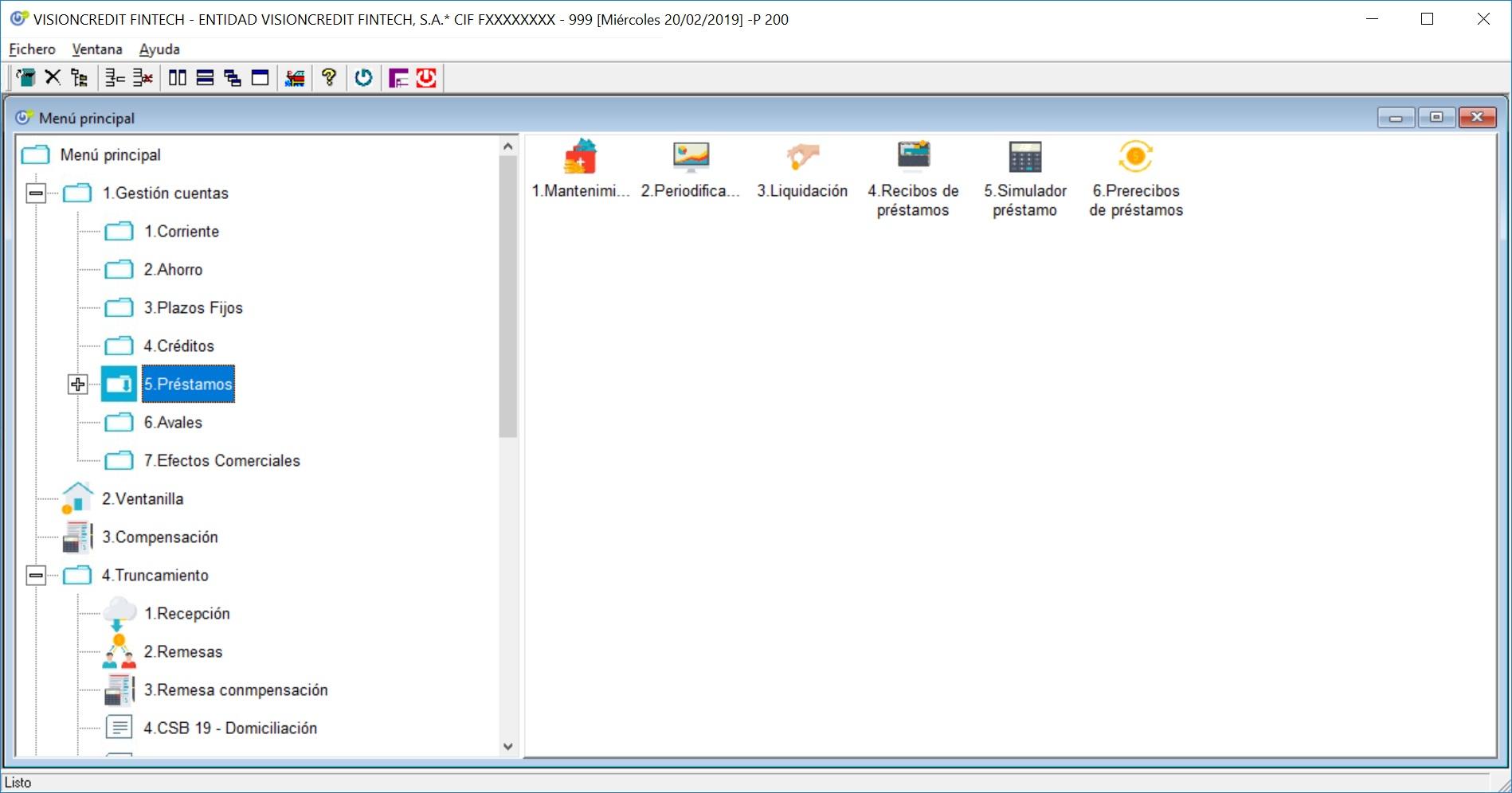

VisionCredit Fintech - Screenshot 2  VisionCredit Fintech - Screenshot 3

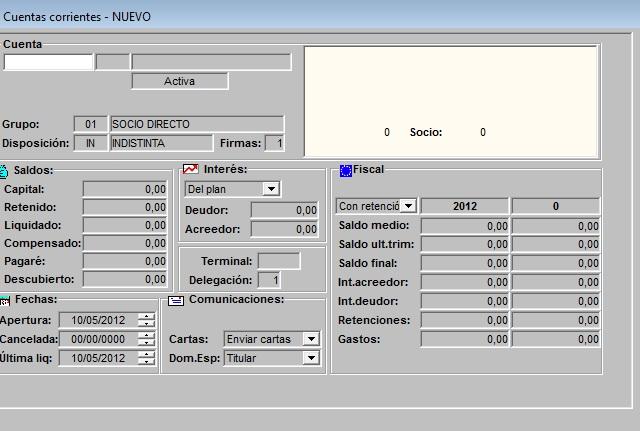

VisionCredit Fintech - Screenshot 3  VisionCredit Fintech - Screenshot 4

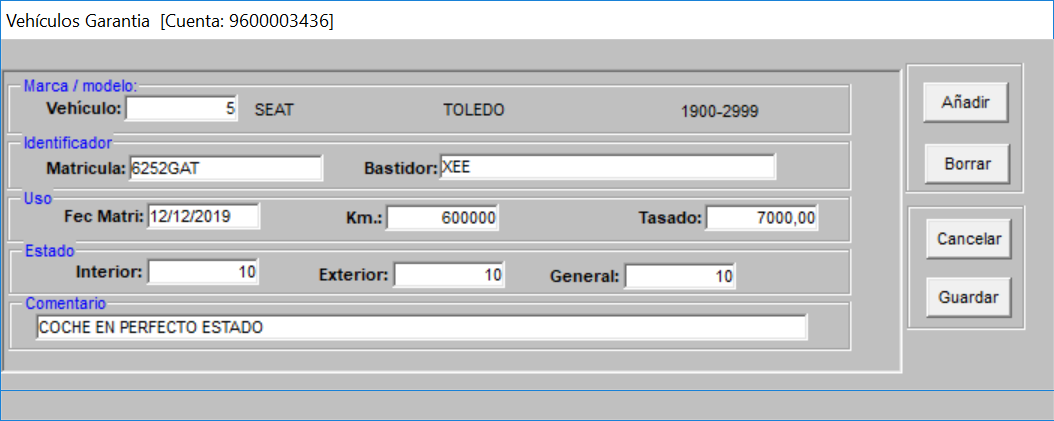

VisionCredit Fintech - Screenshot 4  VisionCredit Fintech - Screenshot 5

VisionCredit Fintech - Screenshot 5  VisionCredit Fintech - Screenshot 6

VisionCredit Fintech - Screenshot 6

VisionCredit Fintech: its rates

Gratuita

Free

Esential

US$999.00

/user

Gold

Rate

On demand

Standard

Rate

On demand

Clients alternatives to VisionCredit Fintech

Global money transfers, multi-currency accounts, and seamless payment solutions for businesses of all sizes.

See more details See less details

Airwallex offers comprehensive features, including global money transfers in multiple currencies, allowing businesses to engage in cross-border transactions with ease. It provides multi-currency accounts, enabling users to hold and manage funds in various currencies without unnecessary conversion fees. With its seamless payment solutions tailored for various business needs, Airwallex empowers companies to streamline their financial operations and enhance customer experiences efficiently.

Read our analysis about AirwallexTo Airwallex product page

Streamlined payment processing, user-friendly interface, and secure transactions make this business card software ideal for managing payments efficiently.

See more details See less details

Takepayments offers a streamlined payment processing solution that enhances efficiency for businesses. Its user-friendly interface ensures easy navigation, while the software prioritises secure transactions to protect sensitive customer information. With features designed to simplify payment management, it caters perfectly to businesses seeking a reliable way to handle monetary transactions seamlessly. Ideal for both small enterprises and larger organisations, it aims to optimise cash flow and improve customer experiences.

Read our analysis about takepaymentsTo takepayments product page

Create and share customised digital business cards effortlessly, manage contacts seamlessly, and analyse engagement metrics to maximise networking opportunities.

See more details See less details

This software offers users the ability to design and distribute personalised digital business cards with ease, ensuring a professional touch in networking situations. Features include seamless contact management to keep information organised and an analytics function that enables users to track engagement rates of their cards. This comprehensive approach not only enhances visibility but also helps in refining networking strategies based on real-time data insights.

Read our analysis about TideTo Tide product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.