ASTON AI : Digital Credit Management & Cash Collection Software

ASTON AI: in summary

More cash, More efficiency, Less Risk

Switch to cash culture with Aston iTF to reduce your payment delays, control your customer risk and improve efficiency. Our digital platform offers you a complete SaaS software solution for digital Credit Management.

ASTON iTF is available on all devices (PC, tablet, smartphone) and on the move. These modules are available in multi-currency, multi-language mode. Aston iTF relies on the flexibility of the cloud and offers an economic SaaS subscription model.

Prevention and Automation

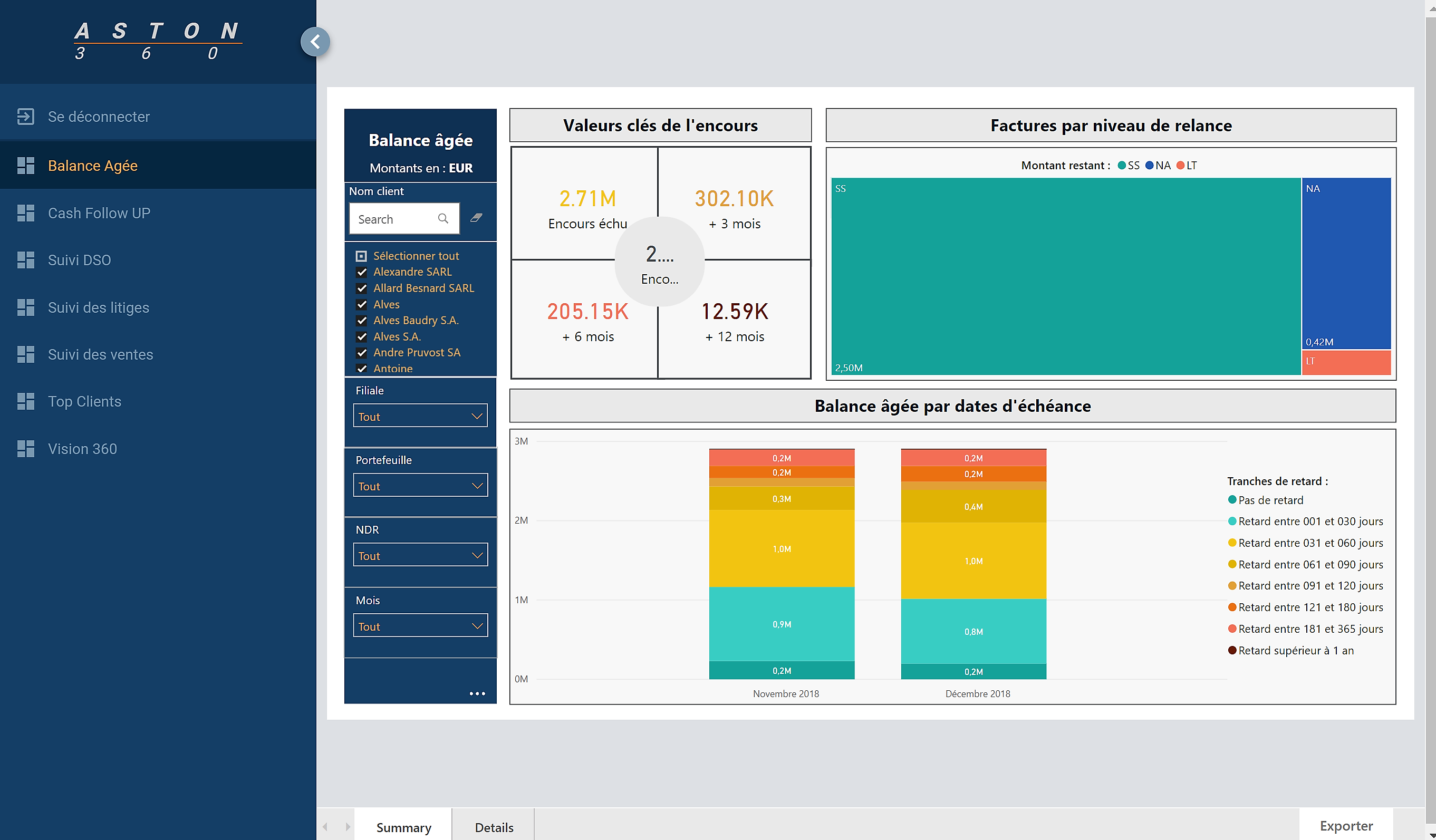

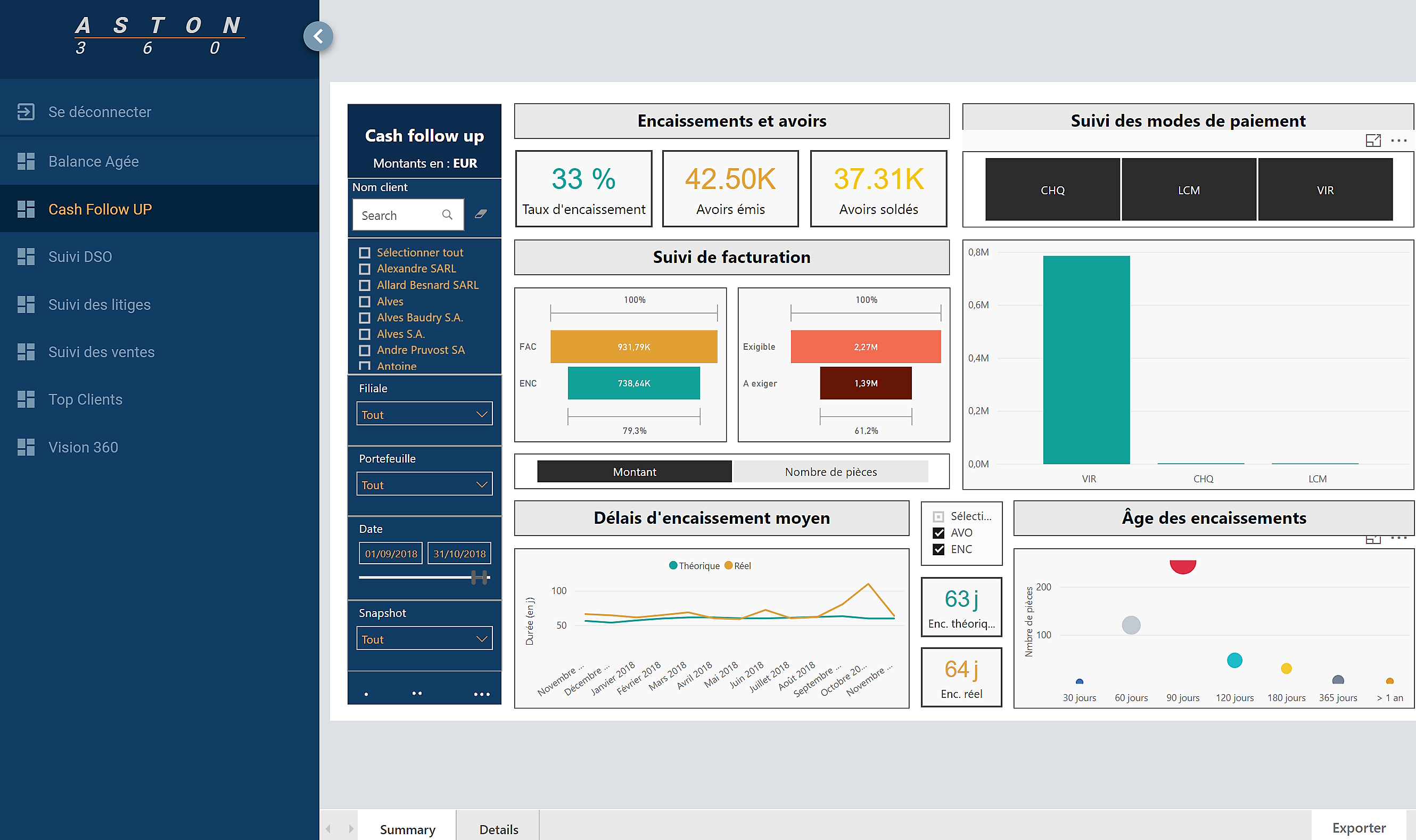

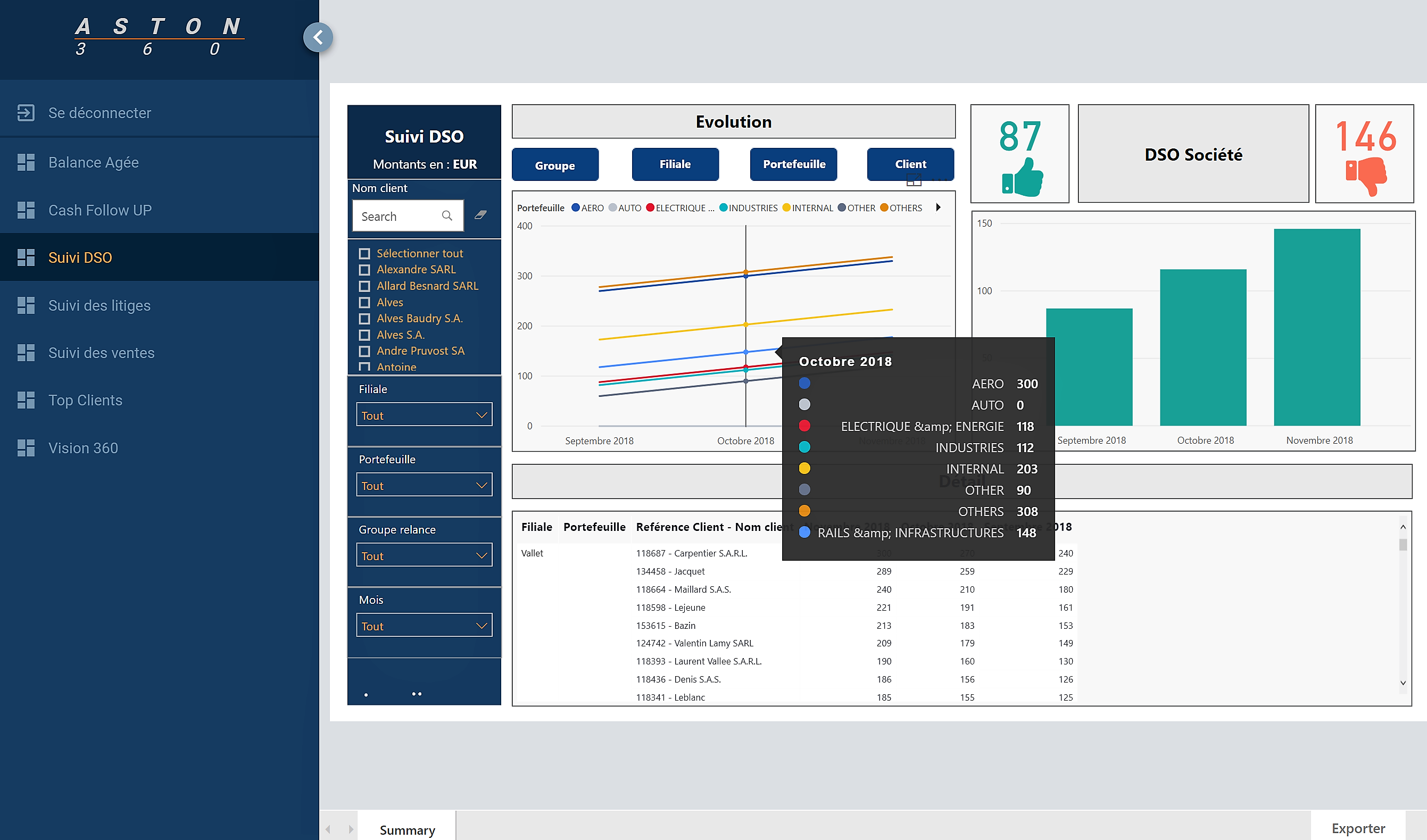

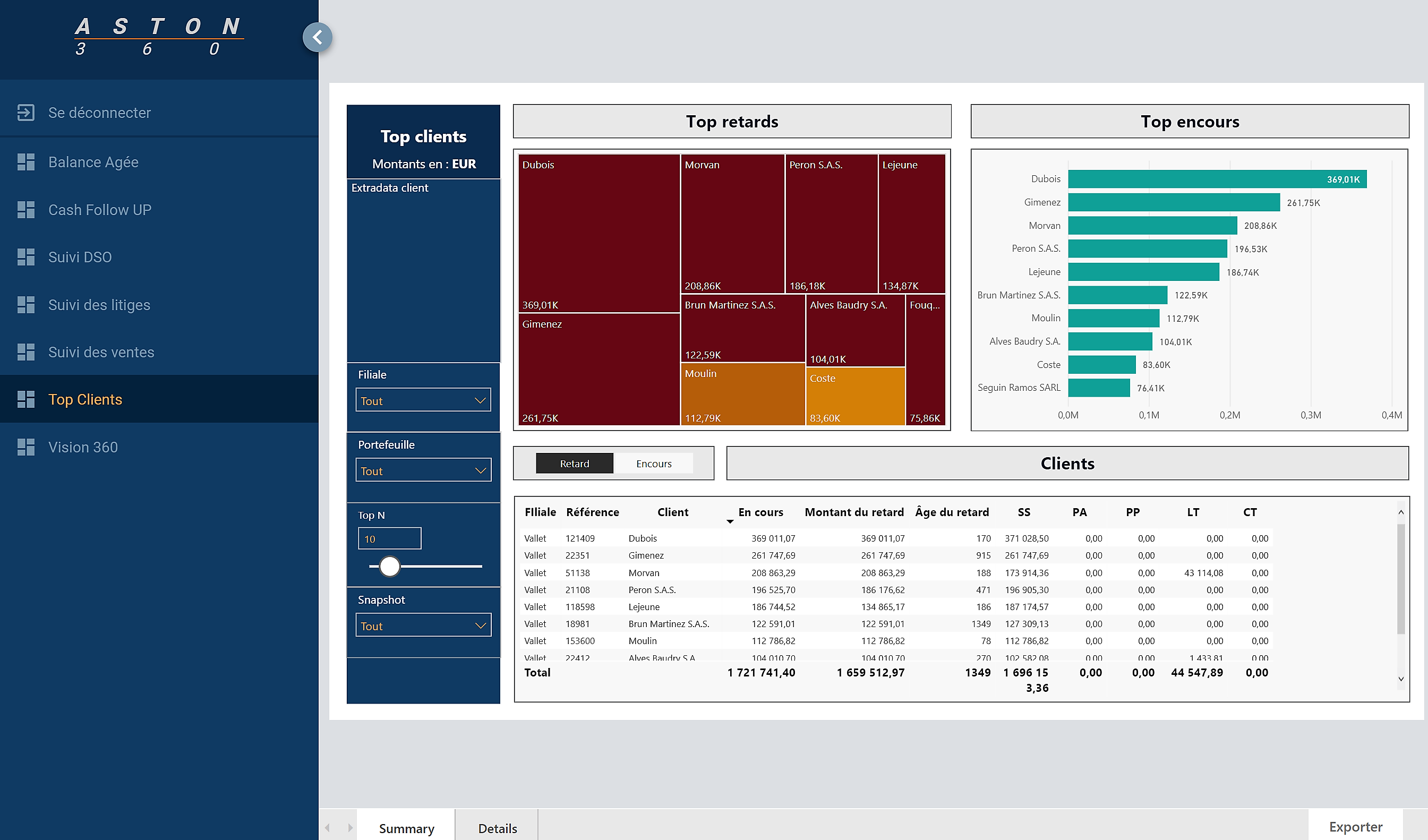

1) Performance analysis - dashboards: get your real time personalized business dashboards in 1 click at group level, subsidiary, Point of Sales, etc. Identify your cash growth sockets and build the right action plan.

2) Customer risk analysis - Scoring: a real-time customer scoring based on their actual payment behavior. All customers information synthetized in a single form. Analyze and share the risk level of each portfolio, subsidiary, agency, ...

3) Cash Collection robotization: Automatize up to 80% of your cash collection actions and reduce your late payments by more than 50%. You will be able to modify dynamic customers portfolios, mail or email templates and cash collection scenarios thanks to our intuitive graphic user interface.

4) Risk mitigation – Credit-risk & Factoring: The Aston iTF platform is delivered pre-connected to leading credit-risk and factor companies. Manage and automatize your credit risk insurance and your factoring contract directly from our platform.

Its benefits

Pricing pay as you use

Flexibility

GDPR, ISO 27001

ASTON AI: its rates

PME

€345.00

/month /5 users

ETI

Rate

On demand

Clients alternatives to ASTON AI

Streamline your expenses and save time with this cloud-based solution.

See more details See less details

This expense management software automates expense tracking, receipt uploads, and approvals, while providing real-time visibility into spending. It also allows for customised budgets and prepaid cards for employees.

Read our analysis about SoldoTo Soldo product page

Streamlined payment processing, multi-currency support, advanced security features, and easy integration with existing platforms ensure a seamless user experience.

See more details See less details

MyGuava Business offers robust solutions for efficient payment processing, featuring multi-currency support to cater to global transactions. Its enhanced security measures safeguard sensitive data, ensuring compliance with industry standards. The software's easy integration capabilities allow businesses to connect effortlessly with their existing systems, facilitating a smooth operational flow. Designed for scalability and reliability, this payment gateway empowers organisations to enhance customer satisfaction while managing their finances effectively.

Read our analysis about MyGuava BusinessTo MyGuava Business product page

Streamline your finances with powerful accounting software that tracks expenses, generates invoices, and manages cash flow.

See more details See less details

With easy-to-use features and robust reporting capabilities, this accounting software simplifies your financial management tasks. Stay on top of your business finances with timely insights and accurate data.

Read our analysis about QuickBooksTo QuickBooks product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.