SAS AML : Advanced Monitoring for Fraud Detection & Prevention

SAS AML: in summary

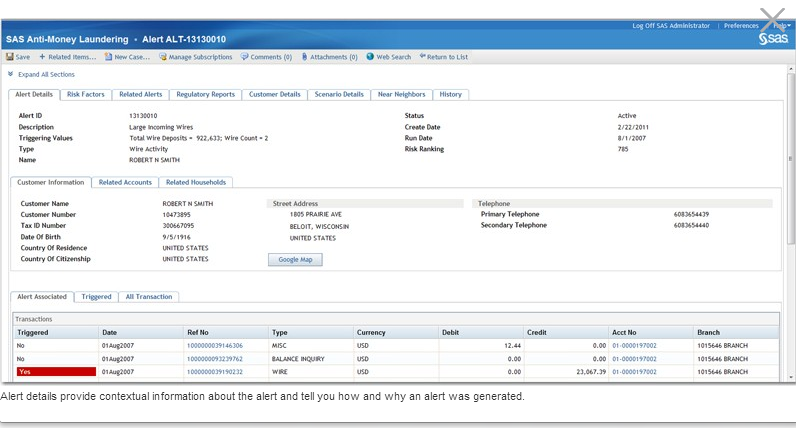

SAS AML caters to financial institutions by revolutionising fraud detection and compliance management. Designed to streamline operations, it offers dynamic monitoring capabilities and robust data analysis, setting itself apart with advanced pattern recognition and a user-friendly risk management system.

What are the main features of SAS AML?

Enhanced Fraud Detection

SAS AML focuses on enhanced fraud detection that leverages advanced analytics and machine learning to identify suspicious activities. This is crucial for financial institutions to mitigate fraud risks effectively.

- Real-time transaction monitoring

- Advanced pattern recognition

- Automated anomaly detection

Comprehensive Risk Management

With an emphasis on comprehensive risk management, the software provides a scalable and adaptable framework to assess various risk factors, ensuring compliance with diverse regulatory requirements.

- Dynamic risk scoring

- Customisable rule sets

- Integration with external data sources

Efficient Compliance Processes

Optimise your compliance operations with SAS AML’s efficient compliance processes. It streamlines the workflow to maintain regulatory adherence while reducing operational costs.

- Automated reporting and documentation

- Flexible audit trails

- Multi-jurisdictional compliance checks

Its benefits

Provided by SCC

SAS AML: its rates

Standard

Rate

On demand

Clients alternatives to SAS AML

Streamline your expenses and save time with this cloud-based solution.

See more details See less details

This expense management software automates expense tracking, receipt uploads, and approvals, while providing real-time visibility into spending. It also allows for customised budgets and prepaid cards for employees.

Read our analysis about SoldoTo Soldo product page

Streamlined payment processing, multi-currency support, advanced security features, and easy integration with existing platforms ensure a seamless user experience.

See more details See less details

MyGuava Business offers robust solutions for efficient payment processing, featuring multi-currency support to cater to global transactions. Its enhanced security measures safeguard sensitive data, ensuring compliance with industry standards. The software's easy integration capabilities allow businesses to connect effortlessly with their existing systems, facilitating a smooth operational flow. Designed for scalability and reliability, this payment gateway empowers organisations to enhance customer satisfaction while managing their finances effectively.

Read our analysis about MyGuava BusinessTo MyGuava Business product page

Streamline your finances with powerful accounting software that tracks expenses, generates invoices, and manages cash flow.

See more details See less details

With easy-to-use features and robust reporting capabilities, this accounting software simplifies your financial management tasks. Stay on top of your business finances with timely insights and accurate data.

Read our analysis about QuickBooksTo QuickBooks product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.