collect.AI : The Order-to-Cash Platform for the AI Era

collect.AI: in summary

collectAI is the next-generation Order-2-Cash Platform for the AI era, designed to revolutionize the way European enterprises liquify their assets. Our cutting-edge AI-driven technology streamlines cash-flow optimization end-to-end, ensuring a world where all receivables are reliably transformed into liquidity.

+50 European Enterprises - over €7.1 billion in receivables volume since 2021 - with collect.AI

Value Proposition:

* Reduced Total Cost of Ownership through automation, streamlining and reduction of capital costs.

* Increased Customer Equity through higher customer satisfaction, loyalty and reputation.

* Optimized Cash Flow by increasing the collection rate and reducing DSO.

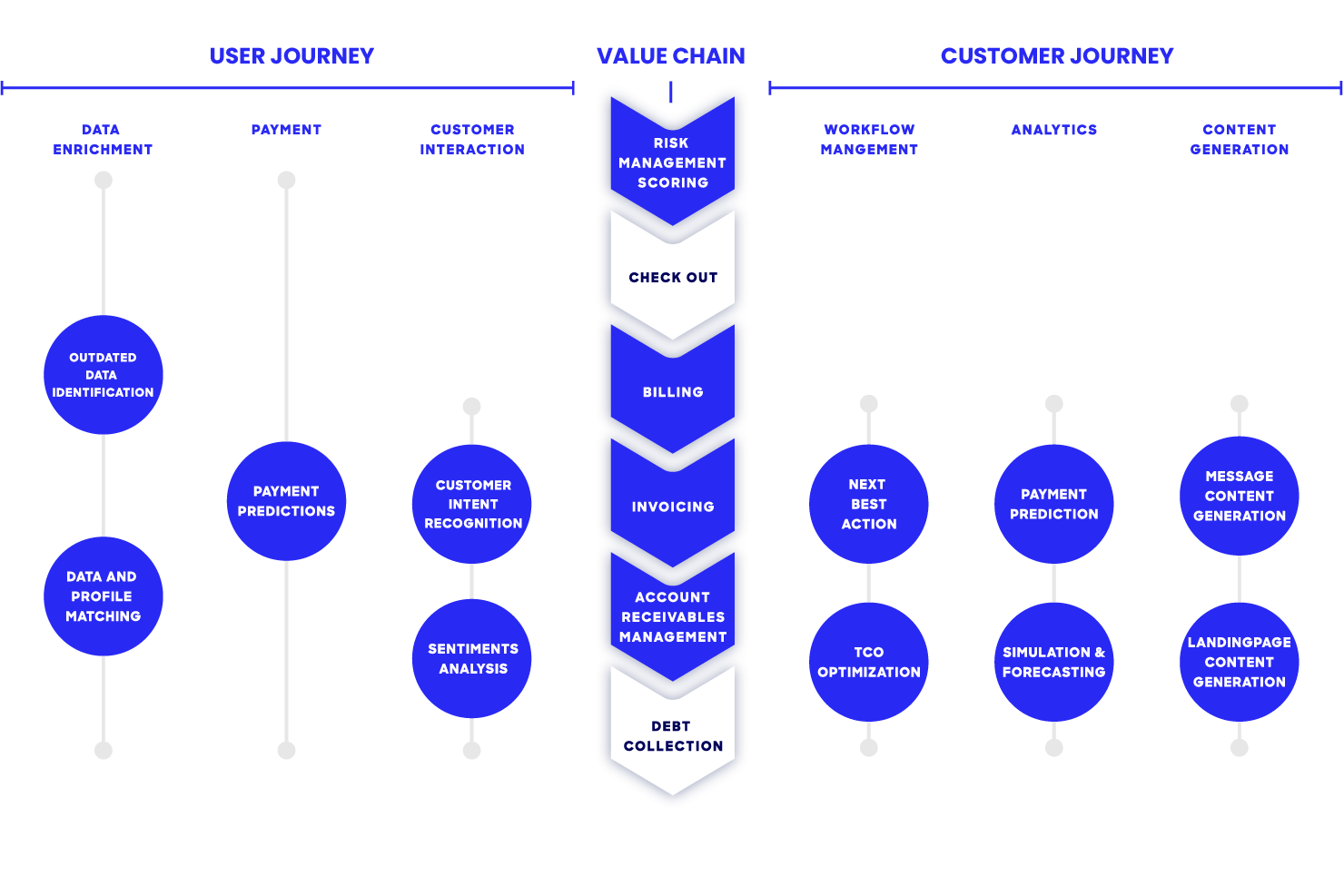

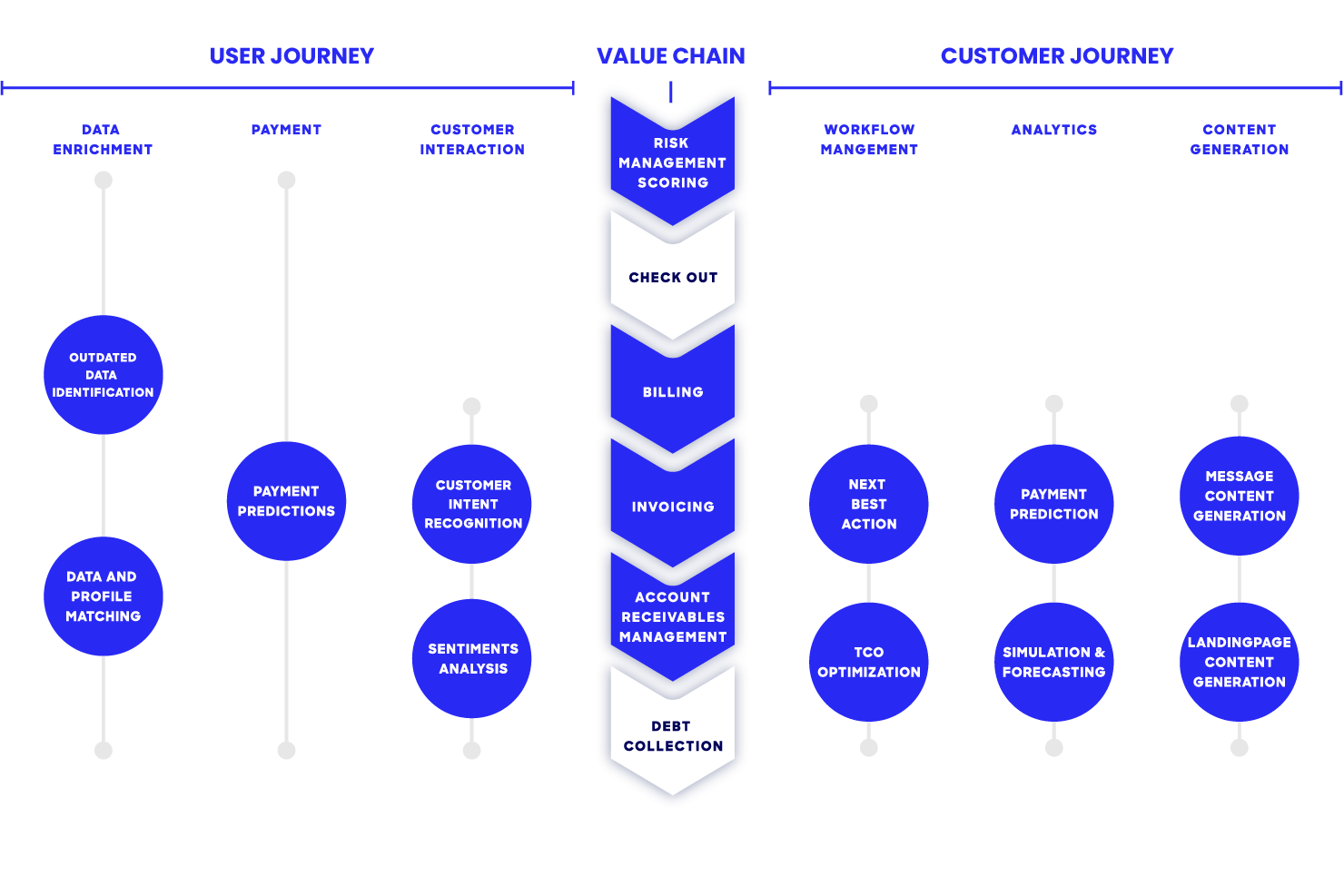

Digital order-to-cash and receivables management

collect.AI helps to significantly increase the performance values of receivables management.

- More than 90% of receivables paid before due date.

- Up to 72% reduction in DSO (days sales outstanding).

- 10% and more is the permanent uplift on the collection rate.

- 30% and more is the reduction in the cost of receivables management.

The portfolio for optimal cash flow

Billing & Invoicing

With Billing & Invoicing, with the goal of reducing dunning rates by up to 75% using new smart assistants that ensure that payment disruptions do not occur in the first place , and to ensure payments arrive steadily with increasing reliability.

Dunning & Collections

Minimizes payment defaults and preventively avoid debt collection - because the AI-Assistants ensure that payment delays are shortened and resolved quickly and efficiently.

Checkout & Payment

Individual payment solutions in the checkout process. The payment AI-Assistant optimize landing pages "on the flight" for conversion, calculate non-payment risks and offer customers the appropriate payment method individually.

Data Enrichment

With Data Enrichment, payment rates can get an additional boost. Continuously updating customer contact data, increasing the digital contact rate (with double opt-in) and collecting direct debit mandates continuously increase the efficiency of the O2C process.

Its benefits

The best trained AI for your O2C process

GDPR

collect.AI - Screenshot 1

collect.AI - Screenshot 1

collect.AI: its rates

Standard

Rate

On demand

Clients alternatives to collect.AI

Create stunning designs with intuitive tools and templates. Effortlessly enhance your projects with advanced typography and image editing features.

See more details See less details

Yooz's Desktop Publishing software offers a user-friendly interface for creating professional designs. With a vast library of templates and easy-to-use tools, you can create anything from flyers to brochures. The software's advanced typography and image editing options enable you to add that perfect final touch to your projects.

Read our analysis about YoozBenefits of Yooz

Most powerful BPMN2 standard-based document workflow engine

Can be integrated with all accounting software on the market

Automatic real-time multi-currency management

To Yooz product page

Global money transfers, multi-currency accounts, and seamless payment solutions for businesses of all sizes.

See more details See less details

Airwallex offers comprehensive features, including global money transfers in multiple currencies, allowing businesses to engage in cross-border transactions with ease. It provides multi-currency accounts, enabling users to hold and manage funds in various currencies without unnecessary conversion fees. With its seamless payment solutions tailored for various business needs, Airwallex empowers companies to streamline their financial operations and enhance customer experiences efficiently.

Read our analysis about AirwallexTo Airwallex product page

Streamlined payment processing, user-friendly interface, and secure transactions make this business card software ideal for managing payments efficiently.

See more details See less details

Takepayments offers a streamlined payment processing solution that enhances efficiency for businesses. Its user-friendly interface ensures easy navigation, while the software prioritises secure transactions to protect sensitive customer information. With features designed to simplify payment management, it caters perfectly to businesses seeking a reliable way to handle monetary transactions seamlessly. Ideal for both small enterprises and larger organisations, it aims to optimise cash flow and improve customer experiences.

Read our analysis about takepaymentsTo takepayments product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.